|

Repurpose Your DB Pension Scheme to Benefit All Stakeholders A Proposal to embrace the role as long term sponsor and ensure scheme supports Group’s S172 Statements and ESG Commitments As the Board considers employee loyalty, wage inflation and its ESG ethos, adopt a C-Suite Pensions Strategy to:

Steps to implement

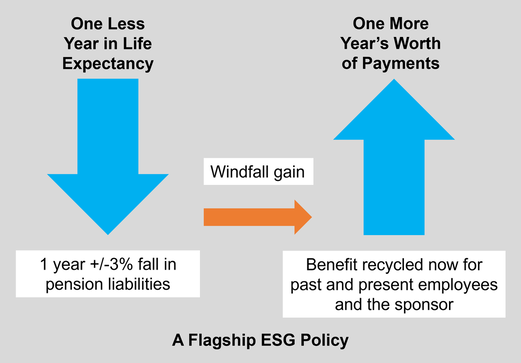

Boards can replace the DB pension “get rid” mindset with a forward looking “run on” policy which works for sponsors, pensioners, employees and shareholders. An ESG Flagship benefits all stakeholders. A Flagship ESG Initiative Campaign for one year less on life expectancy to mean one more years worth of pension related payments for past and present employees An Exercise in Discretion to Benefit All Stakeholders Backdrop Life expectancy assumptions are coming down further in actuarial tables. Liabilities will fall by around 3% to 5% for most DB schemes. Current annual payments to pensioners represent typically around 3% to 5% of assets after recent falls in value (and greater falls in liabilities for the better financially managed). Trustees and sponsoring employers can decide to distribute additionally benefits to past and present employees in response to changed information. This is a straight improvement to the scheme’s finances. The assets are not affected by the assumption changes – as happened when interest rates increased. Standard industry thinking is to accelerate Risk Transfer Transactions. Analysis of the real risks and values is needed. Proposal The benefit of discretionary payments can be split. Increased payments can be made directly to past and present employees. These comply with tax and legislative requirements. C-Suite has worked through the detailed requirements. Sponsoring companies can also benefit from reduced contributions.

The principle of discretionary payments is established. The time over which they are made and the delivery mechanisms are then scheme specific. Campaign Objectives The objective is to help past and present employees in the tough current economic circumstances. The over funding of pension liabilities makes this practical. Sponsors and trustees may then see their pension schemes as Flagship ESG policies not a legacy problem. That results in having a long term investment strategy for the scheme and having a modernised tier within it. Pension scheme members and current employees can put the case to sponsors and trustees for “one less one more” HR as well as finance teams of corporates should take up the opportunity. Member nominated trustees are particularly relevant. Here is a break point where intergenerational unfairness is on the agenda and there is an action plan. |

Archives

July 2024

|

C-Suite Pension Strategies Ltd

80 Coleman Street, London EC2R 5BJ

Registered in England and Wales

Company No. 09974973

80 Coleman Street, London EC2R 5BJ

Registered in England and Wales

Company No. 09974973

RSS Feed

RSS Feed