|

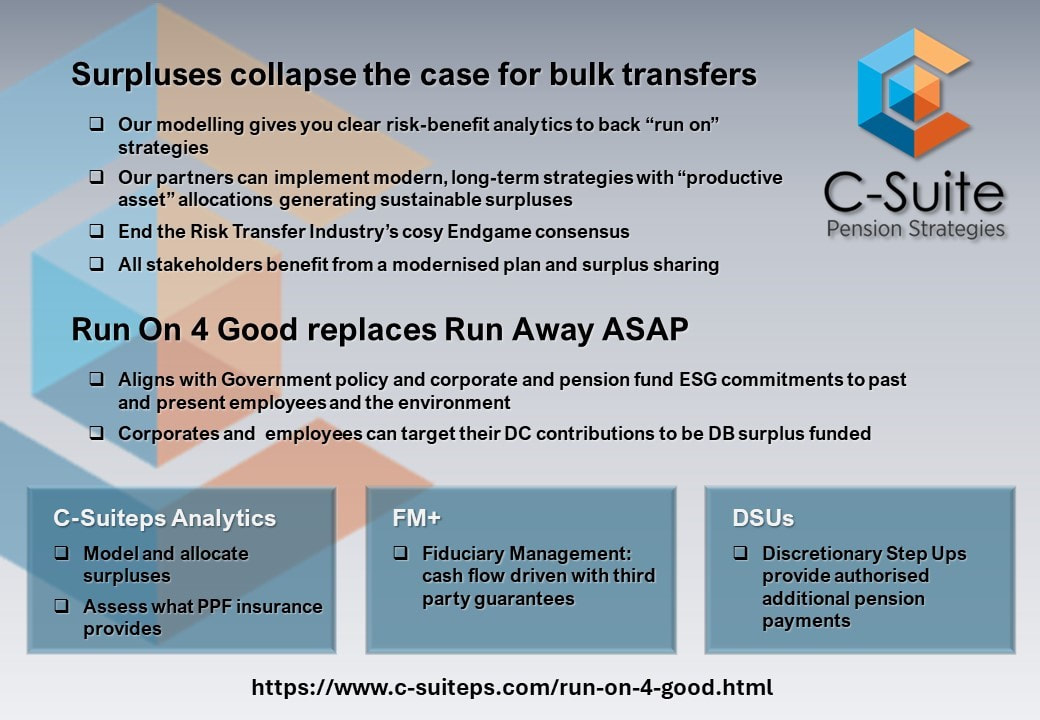

Actuaries are required by new Government regulations TAS300 v2.0 from April 2024 to consider credible alternatives to bulk transfers – like Run On 4 Good – in advising trustees and sponsors. Risk-benefit assessments are required to establish “members’ best interests”. C-Suiteps Analytics provides the modelling. The output challenges standard advice of trustees and their professional advisors. Trustees and sponsors will have to re-engage in strategic rethink ahead of bulk transfers.

Value for Sponsors and Past and Present Employees in Getting Stuck In What to do with surpluses in old Defined Benefit pension schemes? It’s a question Government has put to the pension industry and sponsoring companies in a formal Consultation ending on 19th April. There is a positive answer. Use them to increase pensions and improve pension provision massively for today’s employees at a reducing cost to the employer. There is £300 billion at stake.

The summary is “Run On 4 Good” – keep going steadily on, aiming for stable long-term returns. Then, as excessive optimism about life expectancy becomes ever clearer, the scheme’s trustees will see the scheme has more money than it will ever need. What a great chance to invest in what Government sees as productive assets – like infrastructure. Then set about addressing, with the sponsor, intergenerational unfairness in pension provision and raising pensions- all in a new deal. And it will happen. Provided there is not a public policy error after the Consultation which allows sponsors to syphon large sums back to their Global HQ and still hand pension schemes over to life insurers. Sponsors are big winners. Companies and today’s employees can benefit from DB surpluses paying more and more of their pension contributions as well as discretionary improvements being made to pensions in payment. For scheme members the ultra successful Pension Protection Fund with its £12bn surplus is there covering more and more of remaining payments even in the unlikely event that the sponsor disappeared. And if a scheme can afford a buyout, it can afford not to. Better to ensure the sponsor’s Board see the scheme as a worked example of ESG policy in practice, aligned with its people and environmental priorities. It is a corporate wealth fund. So the case for buyouts has collapsed with surpluses – unless you are part of the cosy, well-heeled actuarial consultancy / life insurer pension axis. A parliamentary Select Committee reported in April concluding too much regulatory caution had largely killed off good pensions. We should not be here. But we are. The art in pensions is to take your time. Exercise discretion. Don’t over commit. But past and present employees should expect more. The pension industry remains obsessed with ‘Endgames’. But it’s not the End and it’s not a Game. Plenty to go for. The downside is remote and falling; the upside can be significant and immediate using existing trustee powers when there is sponsor backing. Members can be impactful. When pensions were just about trustees protecting past benefits, member engagement was modest. And now? Just let employers and trustees know you are keen to hear about their new opportunities to exercise discretion. The Government is rethinking its approach. There is also value for members in getting stuck in. Learn more about Run On 4 Good |

Archives

July 2024

|

C-Suite Pension Strategies Ltd

80 Coleman Street, London EC2R 5BJ

Registered in England and Wales

Company No. 09974973

80 Coleman Street, London EC2R 5BJ

Registered in England and Wales

Company No. 09974973

RSS Feed

RSS Feed