The New Government Mindset

Pension Funding Strategy for 2024

Government Now Encouraging the C-Suite Pension Strategies Approach

Government Now Encouraging the C-Suite Pension Strategies Approach

Government has written to tell the CEOs of The Pensions Regulator and Financial Conduct Authority to “encourage alternatives to derisking and buyout”. C-Suite’s theme that “Run On Pays Off for all stakeholders” aligns with public policy.

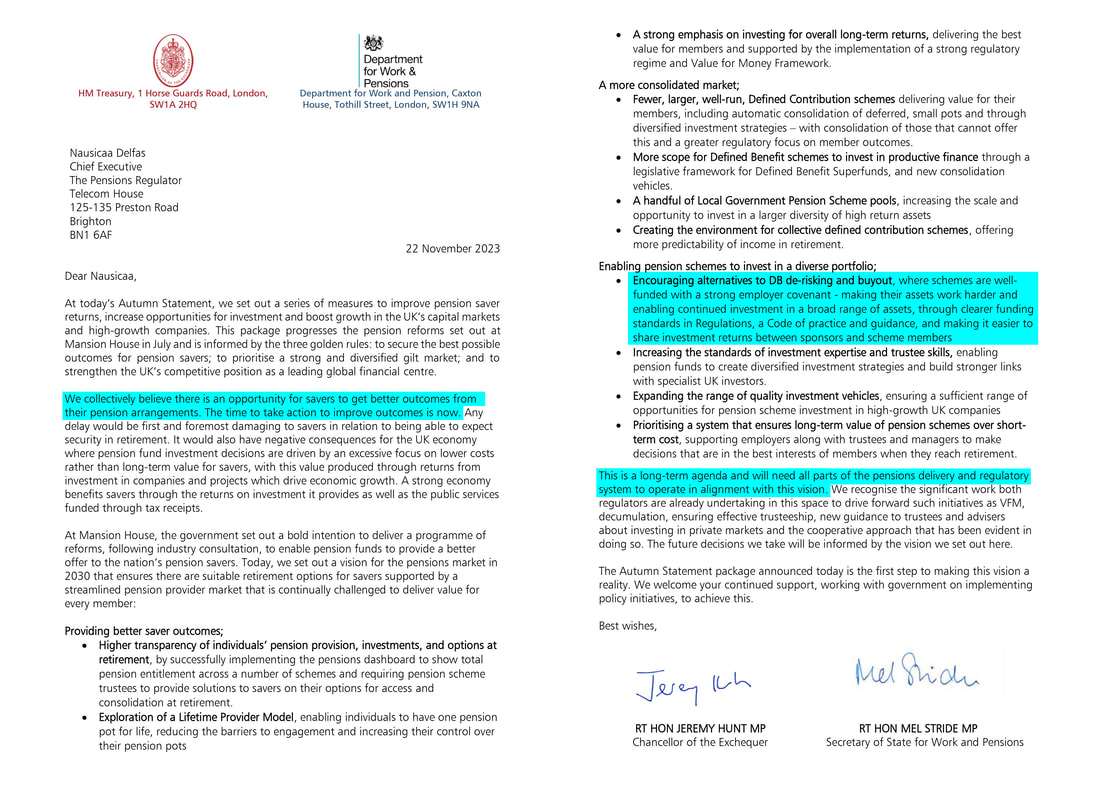

Jeremy Hunt, the Chancellor of the Exchequer and Mel Stride, Secretary of State for Work and Pensions, write in their letters that:

In September C-Suite Pension Strategies wrote to DWP in the Call for Evidence on DB pensions and stated that one sentence from Government would be transformational for the allocation to productive assets and pension provision for past and present employees :

“The Government encourage sound sponsors and trustees of well financed DB schemes to run on and modernise them to be ESG Flagships in all stakeholders’ interests.”

C-Suite has worked on run on ideas for 5 years and knows how to implement them within existing regulatory and legal frameworks. The action Government wants can start now.

Commenting on the Autumn Statement and related letters, C-Suite’s CEO William McGrath said “’Derisk and get rid asap’ now runs against public policy for strong DB scheme sponsors. ‘Run On 4 Good’ replaces the endgame.”

Contact us and our leading partners can help you respond positively to the Government’s initiative.

The letter to Nausicaa Delfas, Chief Executive of The Pensions Regulator is shown below. The same letter was sent to Nikhil Rathi, Chief Executive of the Financial Conduct Authority. The letters add to paragraph 4.34 in the Autumn Statement on investment in productive assets and the sharing surpluses and tax reductions.

4.34 To increase opportunities for defined benefit schemes to invest in productive finance while fully protecting member benefits, the government will consult this winter on how the Pension Protection Fund can act as a consolidator for schemes unattractive to commercial providers and whether changes to rules around when surpluses can be repaid, including new mechanisms to protect members, could incentivise investment by well-funded schemes in assets with higher returns. The authorised surplus repayment charge will also be reduced from 35% to 25% from 6 April 2024.

Jeremy Hunt, the Chancellor of the Exchequer and Mel Stride, Secretary of State for Work and Pensions, write in their letters that:

- We collectively believe there is an opportunity for savers to get better outcomes from their pension arrangements. The time to take action to improve outcomes is now.

- Encouraging alternatives to DB de-risking and buyout, where schemes are well-funded with a strong employer covenant - making their assets work harder and enabling continued investment in a broad range of assets, through clearer funding standards in Regulations, a Code of practice and guidance, and making it easier to share investment returns between sponsors and scheme members.

- This is a long-term agenda and will need all parts of the pensions delivery and regulatory system to operate in alignment with this vision.

In September C-Suite Pension Strategies wrote to DWP in the Call for Evidence on DB pensions and stated that one sentence from Government would be transformational for the allocation to productive assets and pension provision for past and present employees :

“The Government encourage sound sponsors and trustees of well financed DB schemes to run on and modernise them to be ESG Flagships in all stakeholders’ interests.”

C-Suite has worked on run on ideas for 5 years and knows how to implement them within existing regulatory and legal frameworks. The action Government wants can start now.

Commenting on the Autumn Statement and related letters, C-Suite’s CEO William McGrath said “’Derisk and get rid asap’ now runs against public policy for strong DB scheme sponsors. ‘Run On 4 Good’ replaces the endgame.”

Contact us and our leading partners can help you respond positively to the Government’s initiative.

The letter to Nausicaa Delfas, Chief Executive of The Pensions Regulator is shown below. The same letter was sent to Nikhil Rathi, Chief Executive of the Financial Conduct Authority. The letters add to paragraph 4.34 in the Autumn Statement on investment in productive assets and the sharing surpluses and tax reductions.

4.34 To increase opportunities for defined benefit schemes to invest in productive finance while fully protecting member benefits, the government will consult this winter on how the Pension Protection Fund can act as a consolidator for schemes unattractive to commercial providers and whether changes to rules around when surpluses can be repaid, including new mechanisms to protect members, could incentivise investment by well-funded schemes in assets with higher returns. The authorised surplus repayment charge will also be reduced from 35% to 25% from 6 April 2024.

Buyout. Gold Standard. End of Subject. Not Anymore.

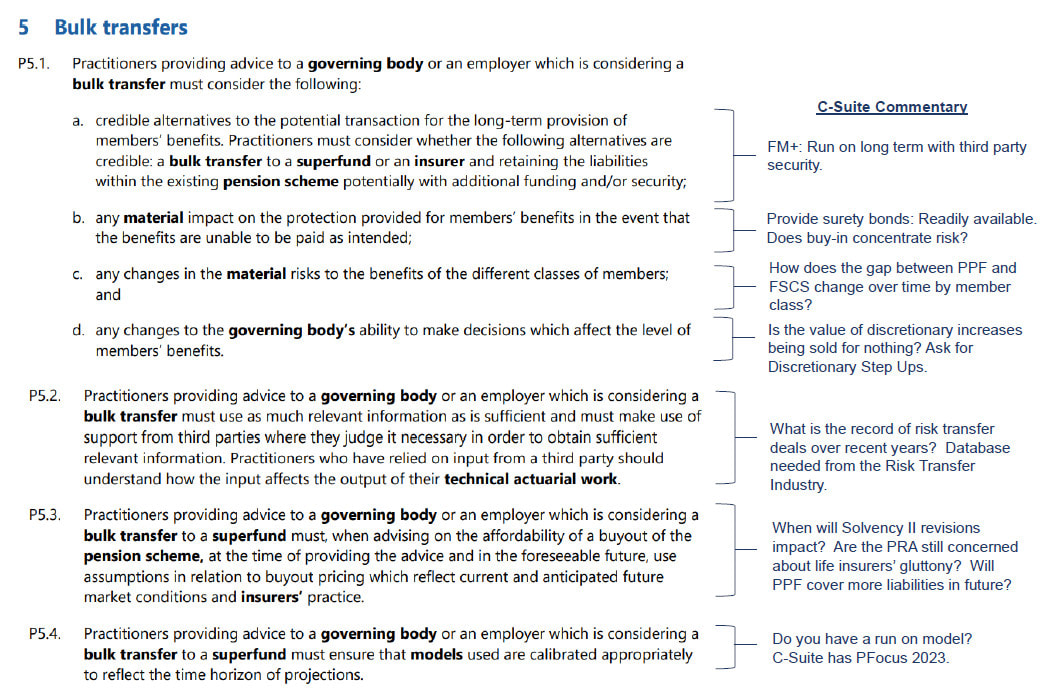

TAS300 2.0 has written C-Suite's “run on” strategies into regulation.

The revised Technical Actuarial Standard 300 says that ahead of bulk transfers actuaries must consider “retaining liabilities in the existing pension scheme potentially with additional funding and / or security”. That’s what C-Suite has been advocating for 5 years and developed with Van Lanschot Kempen into FM+.

TAS300 2.0 should mean trustees and members can expect less presumption and more analysis about what is in their best interests from their actuaries. Is run on a better option when there is third party back up? How much of my pension is covered by the PPF? Is the chance for discretionary increases being sold for nothing? What is the track record of risk transfer transactions? How good are disclosure levels? Are exclusive deals with life insurers a good idea?

Perhaps now actuarial consultants should be less squeamish about providing data on deals they have enthusiastically supported. And the idea that any price which beats actuarial model assumptions and is affordable is a good price will come under scrutiny.

TAS300 was an excellent standard when introduced in 2017. Its weakness was that many actuaries ignored the substance and glossed over it. Now with Government setting a new agenda, scheme members and trustees should be more demanding and question what is best. The Risk Transfer industry should be more specific about how many carats the Gold Standard provides. But will actuaries help the revised TAS300 stick?

The revised Technical Actuarial Standard 300 says that ahead of bulk transfers actuaries must consider “retaining liabilities in the existing pension scheme potentially with additional funding and / or security”. That’s what C-Suite has been advocating for 5 years and developed with Van Lanschot Kempen into FM+.

TAS300 2.0 should mean trustees and members can expect less presumption and more analysis about what is in their best interests from their actuaries. Is run on a better option when there is third party back up? How much of my pension is covered by the PPF? Is the chance for discretionary increases being sold for nothing? What is the track record of risk transfer transactions? How good are disclosure levels? Are exclusive deals with life insurers a good idea?

Perhaps now actuarial consultants should be less squeamish about providing data on deals they have enthusiastically supported. And the idea that any price which beats actuarial model assumptions and is affordable is a good price will come under scrutiny.

TAS300 was an excellent standard when introduced in 2017. Its weakness was that many actuaries ignored the substance and glossed over it. Now with Government setting a new agenda, scheme members and trustees should be more demanding and question what is best. The Risk Transfer industry should be more specific about how many carats the Gold Standard provides. But will actuaries help the revised TAS300 stick?

New Government Regulations for Occupational Pension Schemes 2023: Key Points

The 2004 Pensions Act was updated in 2021 on the need for schemes to have funding and investment strategies. The new Regulations provide detail on what is required to be covered.

Following consultation during 2023, the Department for Work and Pensions issued on 29 January 2024 new “Occupational Pension Schemes (Funding and Investment Strategy and Amendment) Regulations 2023”

Extract from Foreword to the Regulations by Minister for Pensions, Paul Maynard –

“It was never our intention to bear down on risk taking across the board. Rather it was to make funding standards clearer and to promote planning for the long term. By listening to stakeholders, we’ve learned that it is easy to inadvertently drive reckless prudence and inappropriate risk aversion.”

“These Regulations demonstrate the clear scope for most schemes to take more investment risk, while keeping members’ benefits safe.”

Open Consultation on Options for DB Schemes: February 2024

Department for Work and Pensions launched an open consultation on “Options for Defined Benefit Pension Schemes” in February 2024

Ministerial Foreword by Paul Maynard, Minister for Pension and Mel Stride, Secretary of State for Work and Pensions and Consultation: Extracts:

“At Autumn Statement 2023, we committed to a bold range of measures. We will ensure the assets held in UK pension scheme can work harder for scheme members, provide a secure retirement and support the growth of the wider economy “

“We will ensure that employers and savers alike can take advantage of strong investment returns, supported by the revised scheme funding regime, which makes the headroom for more productive investment explicit whilst keeping members’ benefits safe.”

“We will ensure that the assets held in UK pension schemes can work harder for scheme members, provide a secure retirement and support the growth of the wider economy.”

Work and Pensions Committee: DB schemes: Third Report of Session 2023/2024

Key Points from session report:

Final report of Select Committee showed concerns about financial data inconsistencies and emphasises the need for run on options and discretionary benefit payments.

“New questions relating to how DB scheme funding is regulated, how to treat any surplus and how to ensure scheme members feel their interests are represented in these discussion”

TPR approach has been driven by its objective to protect the Pension Protection Fund. Given that PPF now has £12bn in reserves, this objective is no longer needed.

It is important that trustees and employees are able to run the scheme on as an attractive and meaningful alternative. This has potential advantages for: scheme members (of, for example allowing them to continue to receive discretionary increases; the sponsoring employer (able to see well funded schemes as an asset) for the UK economy (enabling trustees to take a longer term view and increase their investment in return-seeking assets) and financial stability (as more scheme would be working towards different long term objectives).

TPR should consider requiring schemes to set out why they have pursued a particular approach and why it is in the best interests for scheme members.

Two decades of regulatory policy caution have almost entirely destroyed the UK’s DB system.

TPR should have “a new objective to protect future as well as past service benefits”

|

Contact us and our leading partners can help you respond positively to the Government’s initiative.

|

|

Read about The C-Suite Approach |