DB Pension Schemes : An Equity Investor Perspective

- Question what “get rid ASAP” strategies have achieved

- ESG aligned strategies can bring new asset allocations

- Government and Regulator attitudes have changed

Equity Investment: The New Wave

DB schemes can be assets not liabilities – seen as a Corporate Wealth Fund and an ESG Flagship. That requires a C-Suite attitude change. Equity investors should stimulate it by questioning the costly drive to annuitise.

A “run on” DB strategy can add to money in more growth orientated DC tiers of schemes. That means residual sponsor solvency risk being addressed. But then the years of net selling of (UK) equities can end and indeed reverse as surpluses build up.

Equity investors asking well directed questions of Chairs, CEOs as well as CFO’s will stimulate a reanalysis and change the mood within the introverted pension consultancy sector.

DB schemes can be assets not liabilities – seen as a Corporate Wealth Fund and an ESG Flagship. That requires a C-Suite attitude change. Equity investors should stimulate it by questioning the costly drive to annuitise.

A “run on” DB strategy can add to money in more growth orientated DC tiers of schemes. That means residual sponsor solvency risk being addressed. But then the years of net selling of (UK) equities can end and indeed reverse as surpluses build up.

Equity investors asking well directed questions of Chairs, CEOs as well as CFO’s will stimulate a reanalysis and change the mood within the introverted pension consultancy sector.

Questions for investors to put to the sponsoring company

Can the:

Equity investors should question the derisking record and propose an ESG aligned alternative.

Help give substance to the Government’s Mansion House reforms.

Can the:

- Company maintain its accounting surplus?

- Scheme pay all its costs including PPF levy?

- Scheme surpluses be used to fund DC contributions?

- Long-term scheme investment strategy align with the Group’s ESG thinking?

- Scheme investment strategy minimise balance sheet volatility?

- The Statement of Investment Principles have a more positive equity strategy?

- Scheme have a positive HR role in requirement and retention?

- Group provide guarantees to cover downside which ensures the scheme does not require cash?

- The actuarial consultants confirm leveraged LDI has not “unsolved” pension funding by creating forced sales from a shrunken asset base to pay members’ actual pensions?

Equity investors should question the derisking record and propose an ESG aligned alternative.

Help give substance to the Government’s Mansion House reforms.

Reversing Negative Trends for Equity Investment

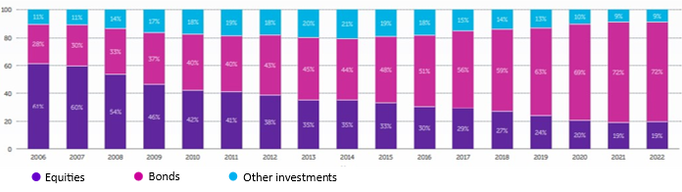

Has the “derisking at any cost” asset allocation strategy worked? Is there a better, balanced ESG aligned plan available?

The switch out of UK equities has been massive over 20 years. That can stop where companies with pension schemes are seen as attractive investments with renewed purpose. The UK equity market will be given a boost. With run on strategies and more money moving into ESG aligned investments, the balance of buyers vs sellers changes. Equity investors are on the front foot – finally.

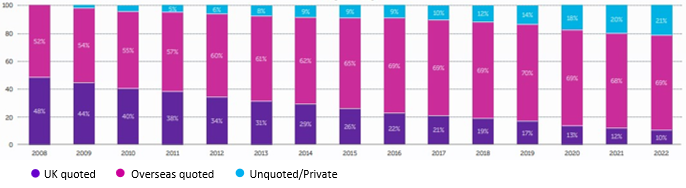

Equity investors have been too passive too long. The graphic shows the consequence of leaving the fixed income teams to it - there is far less equity investment and little of that is in quoted UK stocks.

Has the “derisking at any cost” asset allocation strategy worked? Is there a better, balanced ESG aligned plan available?

The switch out of UK equities has been massive over 20 years. That can stop where companies with pension schemes are seen as attractive investments with renewed purpose. The UK equity market will be given a boost. With run on strategies and more money moving into ESG aligned investments, the balance of buyers vs sellers changes. Equity investors are on the front foot – finally.

Equity investors have been too passive too long. The graphic shows the consequence of leaving the fixed income teams to it - there is far less equity investment and little of that is in quoted UK stocks.

Breakdown of asset classes: Source PPF Purple Book 2022

Breakdown of equity allocations: Source PPF Purple Book 2022

Breakdown of equity allocations: Source PPF Purple Book 2022

Investors: Remain Engaged

Equity investors need to be more questioning. Pension schemes’ investment strategies have been wasteful. The engagement of investors will mean executive management of sponsors will change their outlook.

Invest in UK equities where there is a pension scheme asset. The cost to companies covering the downside for members is modest; the upside of carrying on is substantial for shareholders and members.

Investors: Don’t retire too soon. Benefit from the large investments already made and from asset allocation changes in updated Statement of Investment Principles.

A new positive trend line for UK equity investment can be established.

Equity investors need to be more questioning. Pension schemes’ investment strategies have been wasteful. The engagement of investors will mean executive management of sponsors will change their outlook.

Invest in UK equities where there is a pension scheme asset. The cost to companies covering the downside for members is modest; the upside of carrying on is substantial for shareholders and members.

Investors: Don’t retire too soon. Benefit from the large investments already made and from asset allocation changes in updated Statement of Investment Principles.

A new positive trend line for UK equity investment can be established.