|

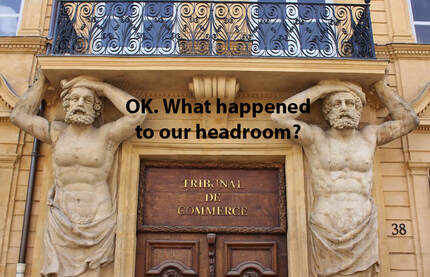

Drinking pension guarantees helps restore it Provide Insurance Guarantee to Schemes of Amounts Rescheduled Covid-19 means company cash flows are being reworked. Headroom under bank facilities and against net debt / EBITDA covenants are central to the remodelling. Dividends and pension deficit contributions are manageable variables. Look at the next 2 year’s payments to the pension scheme. Re-dating those payments 2 years further out or introducing a 2 year delay on all agreed payments may add significantly to the headroom available. Will trustees agree? Perhaps. But by providing a payment guarantee of the 2 years of payments they should. C-Suite Initiative: Key Terms

The guarantee could come from a letter of credit taken as “a permitted use” under banking facilities. But better not to use the core facilities and have a guarantee from an insurer. This widens the financial backing for sponsor and scheme. All Stakeholders Benefit Asking Banks’ credit committees for extra facilities or for covenant waivers in stressed markets is always difficult. Far better to avoid requests if at all possible. Trustees of schemes should see a risk diversifying payment back up as positive and appropriate. In current markets returns on any cash provided will be minimal and 2 years is short term and will not impact “run-off” considerations. With State funding and subsidies of employment costs a further variable, having moved to address pension funding will help the core lenders’ business assessment. For banks and insurers the lines provide a new income source in the surety space, with the scope to expand. Trustees see merit in risk diversification, looking to highly rated institutions. The amount of the guarantee will boost headroom but should not alter the credit profile of the business. The insurance companies will not need to undertake a major credit review. Covid-19 means regulators need to have concern for “sustainability” not just “sustainable growth” of the sponsor. Here is a self-help measure - introducing a new risk diversifying funding source - benefitting all stakeholders. Building headroom within established facilities is a fair way for trustees’ to do their bit’ in Covid-19 times to protect sponsor liquidity and to add to sponsor resilience.. They will be looking to sponsors to provide guarantees that the money will be there later, long before the cash will be needed to meet actual pensions. A pension contribution moratorium is appropriate. Companies can make it happen. Cash and financial capacity are central once more. Many years dealing with Banks told us to avoid asking credit committees to make tough calls in troubled markets unless absolutely necessary. But incisive measures like introducing guarantees of amounts of pension funding deferrals can be a big help to all parties. Provide pension guarantees and deal with it.

Get in touch with us to guarantee a recovery plan for everybody. William McGrath, Founder of C-Suite Pension Strategies [email protected] www.c-suiteps.com |

Archives

July 2024

|

C-Suite Pension Strategies Ltd

80 Coleman Street, London EC2R 5BJ

Registered in England and Wales

Company No. 09974973

80 Coleman Street, London EC2R 5BJ

Registered in England and Wales

Company No. 09974973

RSS Feed

RSS Feed