|

DB Risk Transfer Industry Needs To Be Evidence Based and Monitored Bad Track Record: Accounting Transparency: Information Asymmetry: Insurer Profits: Regulatory Arbitrage: Forced Selling: Gluttony Multi-Asset Managers Should Provide Long Term Alternative “The Use of Longevity Swaps and Buy-Ins, and Other Unforced Errors” is a research paper from C-Suite Pension Strategies. It is the type of paper the risk transfer industry itself should produce.

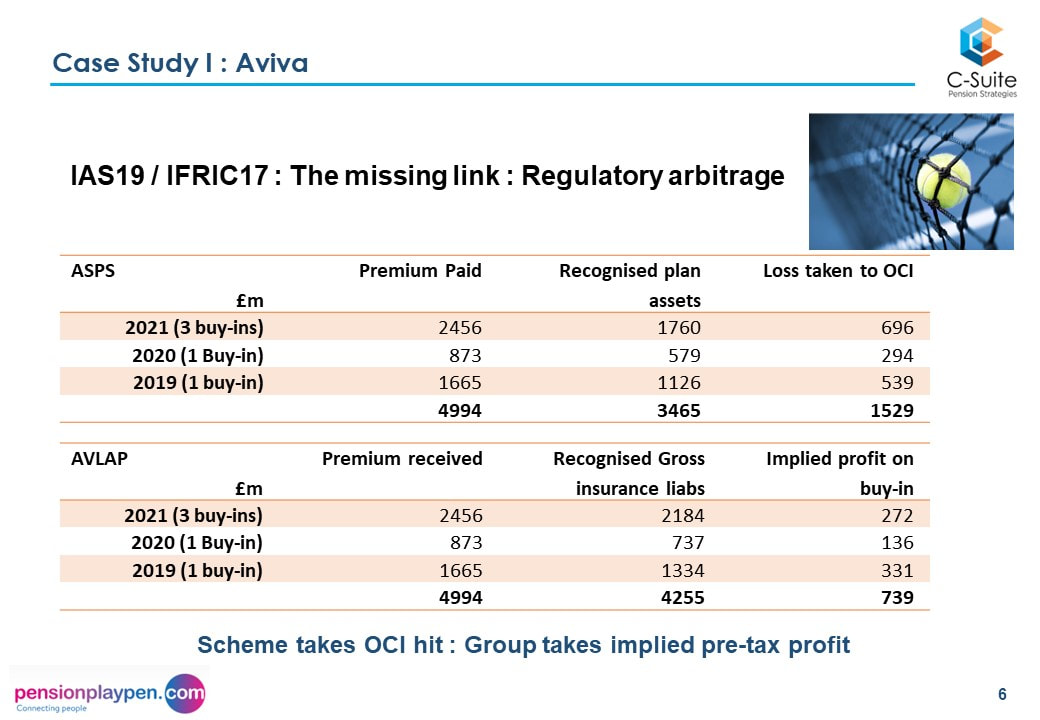

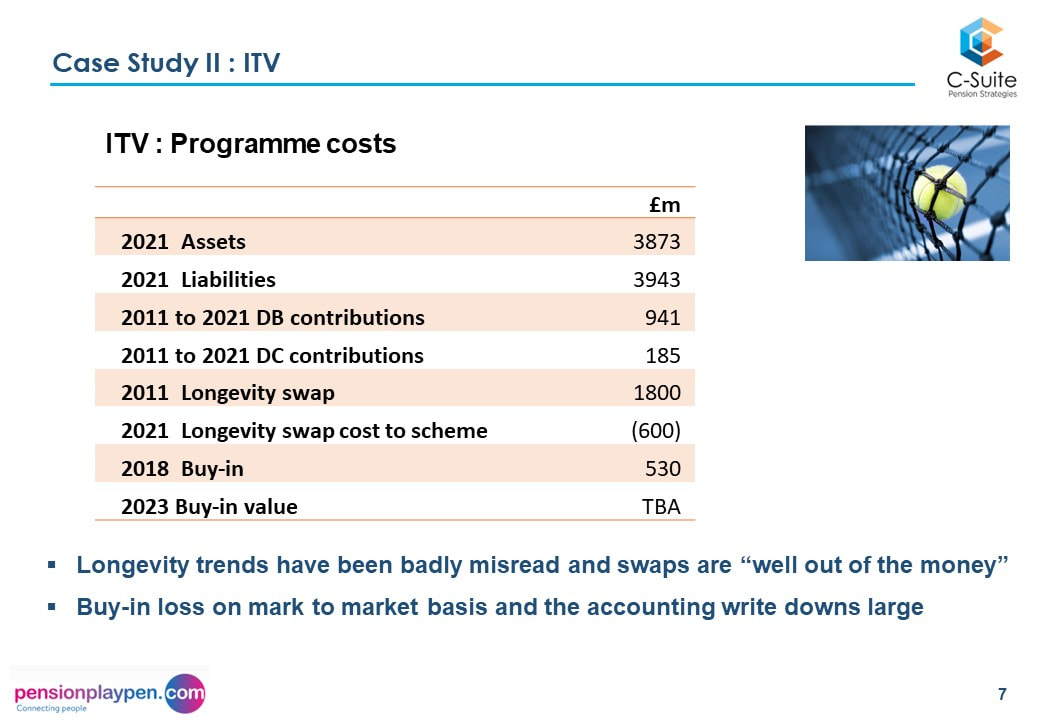

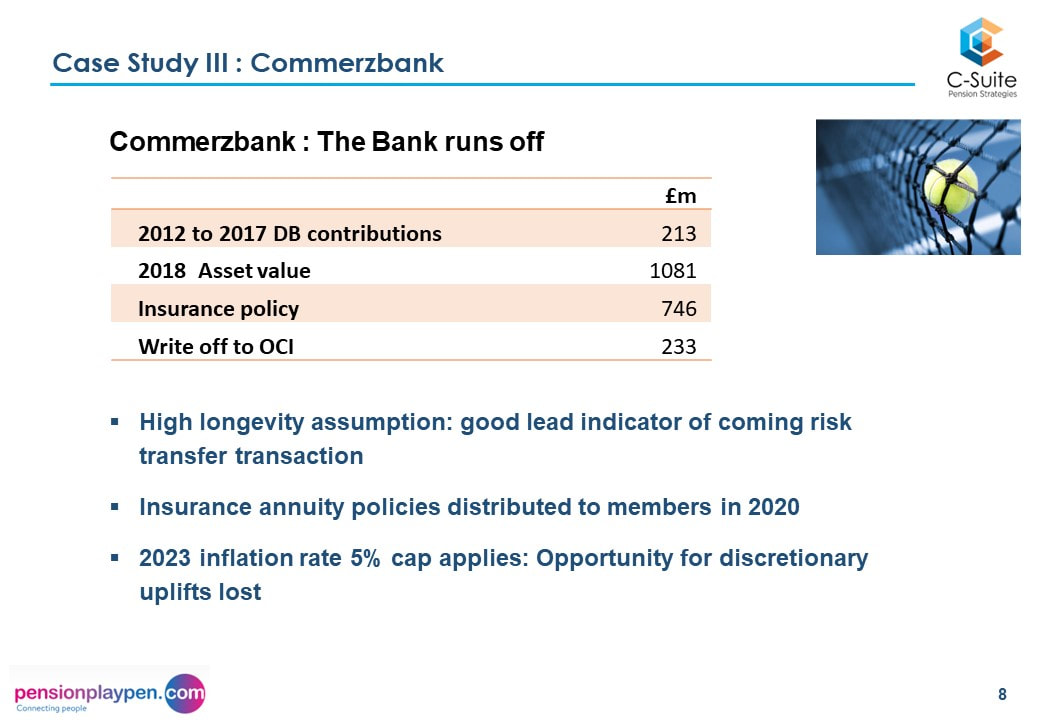

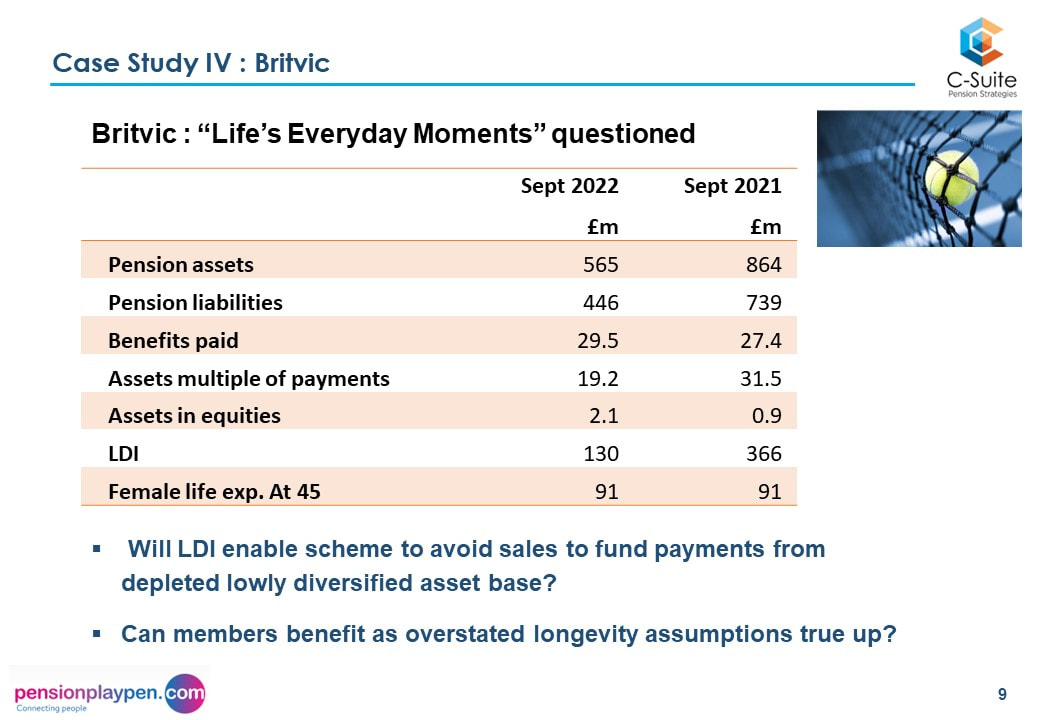

C-Suite looks at specific cases of risk transfers by DB pension schemes. The work indicates:

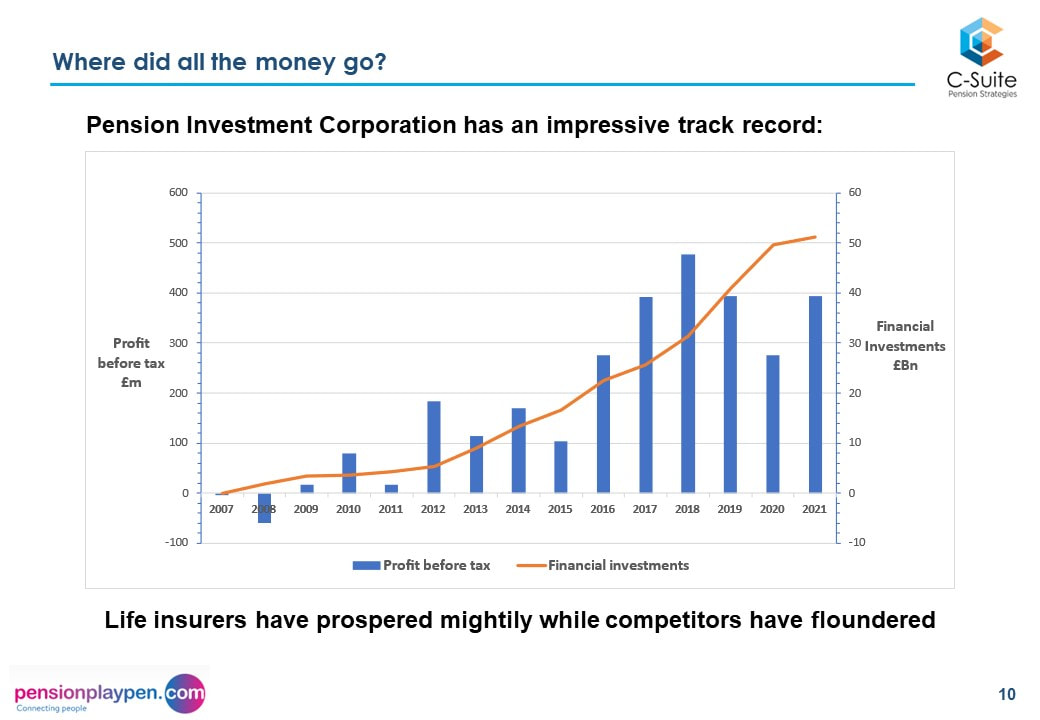

A conclusion is that heeding the Siren calls of the risk transfer industry can sound an unfortunate endgame to pension Odysseys. The downgrades to life expectancy to come in 2023 will add to the impact of interest rate increases and will make buy in deals look worse still. “Get rid journey plans” remain dominant. More unforced errors will follow if the takeaway from the leveraged LDI crisis is to sell illiquid investments at the wrong time to protect a flawed strategy in which interest rate risk elimination is the absolute requirement. 2022 financial statements are showing asset write downs of a third, but better overall funding positions for schemes without excessive hedging in place. Does that mean discretionary cash payments to members facing rising inflation is an agenda item? Or is the plan to accelerate to buy out? When it comes to paying pensions from much reduced asset bases, whether leveraged LDI has delivered or brought forced asset sales will become clear. Time for the Risk Transfer Industry to be evidence based. Bank of England has stated there are clear risks in life insurers’ business practices and their gluttony. Life insurers need to work harder to justify the sweet treats actuarial consultants serve up for them. Consultancies should provide their own market studies. The Alternative C-Suite Pension Strategies’ own view is that schemes should consider running on with a stable, long term investment strategy and with the sponsor providing third party surety backing for the scheme. Then the parties can work out how surpluses generated can best be allocated. Such an approach is now included in TPR’s stated options in its Annual Funding Review. "Derisking techniques are risky and come at a considerable opportunity cost. Greater transparency is much needed. Now is the time for equity and multi-asset managers to provide an alternative" William McGrath |

Archives

July 2024

|

C-Suite Pension Strategies Ltd

80 Coleman Street, London EC2R 5BJ

Registered in England and Wales

Company No. 09974973

80 Coleman Street, London EC2R 5BJ

Registered in England and Wales

Company No. 09974973

RSS Feed

RSS Feed