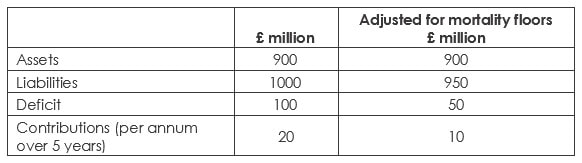

Indicative Calculation The balance sheet improves by £50 million pre-deferred tax. The P & L benefits by £50 million x the discount rate of a double A corporate bond. Time out. A rethink is needed before contributing more cash

Finance directors are outgunned by the chair of the pension trustees. The power shift from the company to the trustees has overshot. Today the chair of the trustees has more time, better resources, an army of advisory troops and an excellent battery of financial instruments. The collapse of a small number of schemes has created an atmosphere of extreme, over-bearing caution. The posture of regulators has allowed trustees to attack dividends. They are achieving remarkably easy access to corporate treasuries. What they do not have is the need to balance the interests of all stakeholders, now that most schemes have severed their interest in current employees and their pensions. They have a desire to achieve financial independence as quickly as possible and to show them the way, they have formidable consultants with fixed income sales backgrounds to hedge and to annuitise. Finance directors should hit back. They need to have their own financial models of deficit recovery plans and put forward specific proposals. They should be using bank and insurance backed instruments to provide guarantees that enable trustees to diversify and reduce risk. They can regain ground by showing they stand for a pensions eco-system that is interested in both current and former employees. This is set against the background of a corporate which uses capital wisely. The Pensions Regulator produced an excellent framework document in 2015 on Integrated Risk Management that covers the sponsor’s covenant, investment and actuarial funding. It encourages all parties to collaborate and get stuck in. They should. Power fills a vacuum. |

Archives

July 2024

|

C-Suite Pension Strategies Ltd

80 Coleman Street, London EC2R 5BJ

Registered in England and Wales

Company No. 09974973

80 Coleman Street, London EC2R 5BJ

Registered in England and Wales

Company No. 09974973

RSS Feed

RSS Feed