|

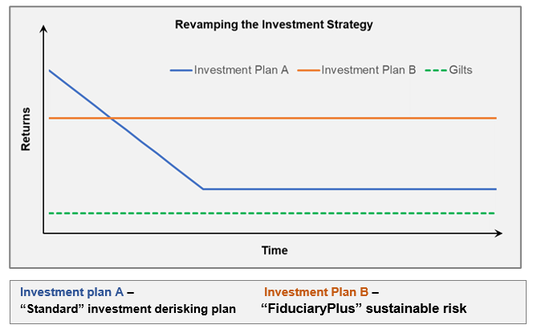

Making old DB pension schemes invest so heavily in low cash returning government bonds may not be the best use of limited resources. Well financed schemes have run the hard yards of derisking and cash contributions so, should the aim be to hand over to life insurance companies? The irony is that if you can afford to do it, you don’t need to yet and there are better ways forward for all stakeholders. The derisking approach is based on a fear for the future of the sponsor of the scheme. The answer can be to address it directly with a surety style product from a financial institution. Banks and insurers are surprised they are not asked about such products. Capacity and pricing are all attractive. Once in place it means the scheme always has a fall back cash source. Downside addressed, the scheme can use long term actuarial and investment strategies which just factor in more time. That is time in which the high levels of actuarial prudence “trues up”. Meanwhile in investment terms, good, solid, stable returns can be made – in steady (perhaps even UK) assets. Illiquidity is no problem and “mark to market” culture less of a driver if you know the cash is not yet needed. What about more commitment to infrastructure investment? That fits back to the original idea of DB schemes helping to fund real economy growth and employment. The graphic shows what is happening now with the “derisk and sell off” plan contrasted with the “flat line” approach. Given half a chance, most asset managers would go for the flat line strategy. All that is really required is for a new collaboration . The Pensions Regulator introduced the framework for just that five years ago in the form of the Integrated Risk Management exercise. This allows actuaries, asset managers and bankers to cross cultural divides and work together.

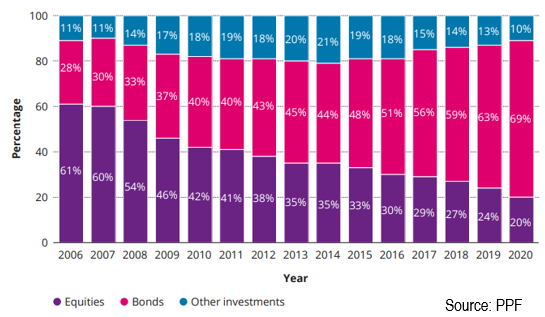

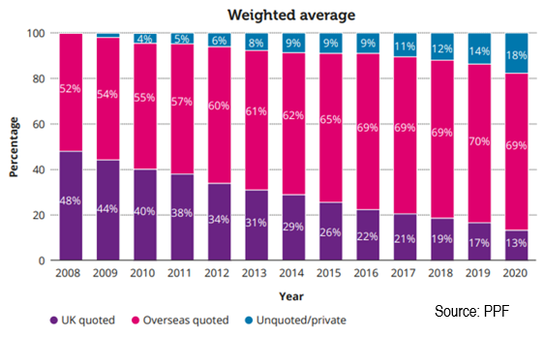

So what happens if the scheme is overfunded? Excellent news. Plan for it now. For the trustees and sponsor there can be a “Reactivation Moment” for the scheme on a DC basis in a new tier. This means that there is scope to improve benefits for members old and new. For corporates, surpluses can be used to meet current DC contributions – an earnings boost. Improvements all round can be a positive feature for HR to put to new employees. And it’s good for Environmental, Social and Governance commitments and Section 172 Statements on its approach to employees. There is no need to make the controversial step of winding up the scheme or taking cash out. Far better to make the scheme an explicit part of an employment approach. Pension funding can switch from dull backwater to a positive statement by the business about its ethos. £14bn has been spent every year for over a decade to fund Defined Benefit (DB) pension scheme deficits. £30bn of pension liabilities were transferred last year to the booming life insurers. Why? Because derisking is seen as good and the pension regulators are intimidating. But are better outcomes possible? What if the sector’s “Gold Standard” of life insurance annuitisation is like the Gold Standard of the 1920’s and just an economy distorting bad idea. What if, by seeking to fill up pension black holes, we have actually already created magic money trees. If so, perhaps we should help them grow. Environmental, Social and Governance inspired directors could review their strategy to find out. Perhaps it’s time to take your time with the DB Pension Scheme. Hold on tight to a steady, low risk approach to pension funding; focus on the actual cash required and, as actuarial prudence trues up, very many schemes will have more than enough resource. The question then is how best to divide the cake. But first, where are we now? We are in a better place than we acknowledge. The Pension Act 2004 set up the Pension Protection Fund (PPF), raised regulatory standards and forced up contribution levels. A triumph is that the PPF is really quite small after 15 years and is very well funded. But high profile corporate failures inspired the new Pension Schemes Act 2021. It has a toughened up The Pensions Regulator who is ready to finish the derisking job. Fair enough unless the sponsor offers an alternative bespoke solution. Responding to all these pressures, investment derisking continues. Back in 2008 54% of money was in equities and 33% in bonds. Now its 20% and 69%. Further, UK equities are now just 13% of the reduced portfolio down from 48%. No help for the UK economy then. UK indexed linked gilts - that’s the expensive asset class of choice. The priority given to funding DB schemes has consequences. Provision for current employees is at much lower levels and is now on a Defined Contribution basis. The corporate takes no continuing investment risk. Many companies pay far more to supplement DB members than they spend on their current workforce.

“Get rid” is all pretty explicable – particularly where the owners are foreign groups who bought UK businesses dimly aware of DB pensions. It’s hard to make UK investments a priority when the concern is that the “legacy” pension schemes take most of the cash generated. So now the winners are fixed income sales teams and life insurers. And there is a well formulated “fast track” coming along from The Pensions Regulator to provide more of the same. Current employees and investment levels in UK plc need an alternative way forward. We can redirect resources and build on the timely caution of recent years in the pension sector. All this is possible. Using the DB Pension scheme magic money tree will result in benefits for all stake holders. |

Archives

July 2024

|

C-Suite Pension Strategies Ltd

80 Coleman Street, London EC2R 5BJ

Registered in England and Wales

Company No. 09974973

80 Coleman Street, London EC2R 5BJ

Registered in England and Wales

Company No. 09974973

RSS Feed

RSS Feed