|

“Look. Companies are not paying enough money into their pension schemes. One way or another we’re going to make them.” So retorted a senior figure at The Pensions Regulator a decade ago when its methodologies were questioned. Years pass but the strategy remains the same.

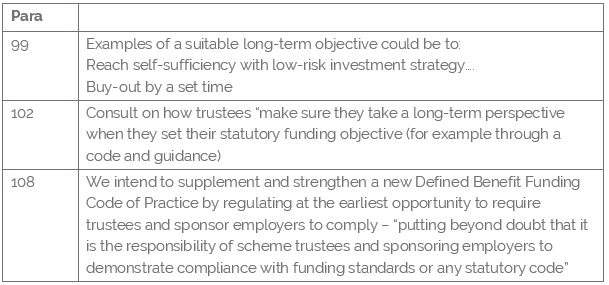

That thinking underpins the recent Pensions White Paper and the most recent funding statement from The Pensions Regulator. Post BHS and Carillion, TPR will have more powers to get its way. So much we know. But the White Paper goes further than before. The power is at present to force statutory actuarial deficits to be paid off. But what about going further to self-sufficiency and annuitisation? The White Paper emphasises that is where their journey is headed. It means more low-return investments and more cash from employers. That is what taking a long-term view when setting the Statutory Funding Objective means in practice. Well financed companies should simply reach their long-term objective quicker. Corporates ready to live with their pension schemes need to have a better alternative route forward – even if it ultimately leads to the same destination. So, what should you do? Have a ’higher for longer’ mainstream investment strategy, able to reduce the actuarial deficit. Have catastrophe life insurance cover to fund the transfer to a regulated insurer or pension consolidator should the sponsor be insolvent. Avoid excessive early derisking. Extracts from Pensions White Paper - Protecting Defined Benefit Pension Schemes Chapter Two: We will: Strengthen the Regulator’s ability to enforce Defined Benefit Scheme funding standards, through a revised code focusing on:

|

Archives

July 2024

|

C-Suite Pension Strategies Ltd

80 Coleman Street, London EC2R 5BJ

Registered in England and Wales

Company No. 09974973

80 Coleman Street, London EC2R 5BJ

Registered in England and Wales

Company No. 09974973

RSS Feed

RSS Feed