|

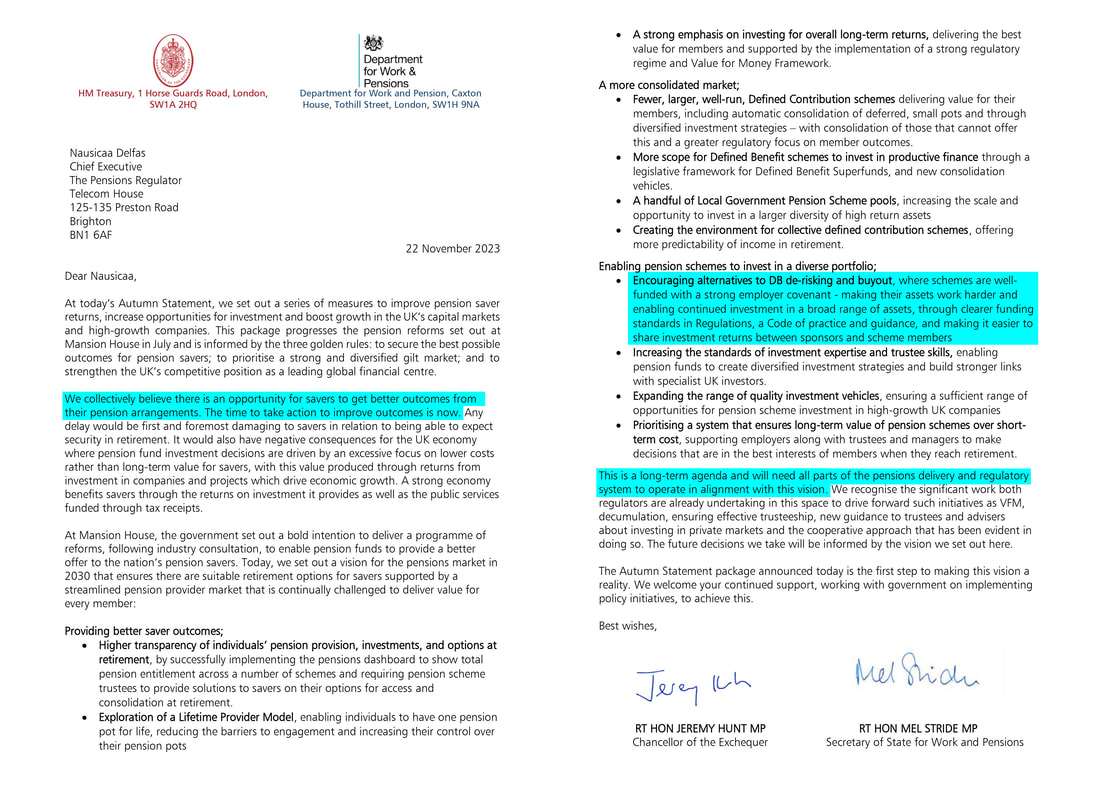

Government has written to tell the CEOs of The Pensions Regulator and Financial Conduct Authority to “encourage alternatives to derisking and buyout”. C-Suite’s theme that “Run On Pays Off for all stakeholders” aligns with public policy.

Jeremy Hunt, the Chancellor of the Exchequer and Mel Stride, Secretary of State for Work and Pensions, write in their letters that:

In September C-Suite Pension Strategies wrote to DWP in the Call for Evidence on DB pensions and stated that one sentence from Government would be transformational for the allocation to productive assets and pension provision for past and present employees : “The Government encourage sound sponsors and trustees of well financed DB schemes to run on and modernise them to be ESG Flagships in all stakeholders’ interests.” C-Suite has worked on run on ideas for 5 years and knows how to implement them within existing regulatory and legal frameworks. The action Government wants can start now. Commenting on the Autumn Statement and related letters, C-Suite’s CEO William McGrath said “’Derisk and get rid asap’ now runs against public policy for strong DB scheme sponsors. ‘Run On 4 Good’ replaces the endgame.” Contact us and our leading partners can help you respond positively to the Government’s initiative. The letter to Nausicaa Delfas, Chief Executive of The Pensions Regulator is shown below. The same letter was sent to Nikhil Rathi, Chief Executive of the Financial Conduct Authority. The letters add to paragraph 4.34 in the Autumn Statement on investment in productive assets and the sharing surpluses and tax reductions. 4.34 To increase opportunities for defined benefit schemes to invest in productive finance while fully protecting member benefits, the government will consult this winter on how the Pension Protection Fund can act as a consolidator for schemes unattractive to commercial providers and whether changes to rules around when surpluses can be repaid, including new mechanisms to protect members, could incentivise investment by well-funded schemes in assets with higher returns. The authorised surplus repayment charge will also be reduced from 35% to 25% from 6 April 2024. “Run on pays off” for Defined Benefit schemes with a stable, long term investment strategy: Provide third party, risk diversifying guarantees: All stakeholders can share the benefits and surpluses.

These are the C-Suite themes which go right back to our 2018 webinar setting out a radically different mindset to improve pension provision. Our cutting edge analysis in our paper from 2020, “Running On Pays Off”, showed why an alternative to the rush to “get rid” to a life insurer was needed. The themes are now seen in our “Run On 4 Good” advocacy of aligning corporate and pension scheme ESG thinking. To go mainstream and transform pension provision we urged Government to state that it encourages well funded schemes with strong sponsors to align with its pro-investment thinking. One sentence can be transformational, we noted in responding to the recent DWP Call for Evidence: “The Government encourage sound sponsors and trustees of well funded DB schemes to run on and modernise them to be ESG Flagships in all stakeholders’ interests.” Now Jeremy Hunt has provided an equivalent sentence in his Autumn Statement. Our proposals work within the existing regulatory framework which means you can move forward now rather than wait for legislation. 4.34 To increase opportunities for defined benefit schemes to invest in productive finance while fully protecting member benefits, the government will consult on whether changes to rules around when surpluses can be repaid, including new mechanisms to protect members, could incentivise investment by well-funded schemes in assets with higher returns. The authorised surplus repayment charge will also be reduced from 35% to 25% from 6 April 2024. Should you wish to see how your DB scheme becomes and ESG Flagship we would be pleased to discuss – in particular Discretionary Step Ups and the FM+ approach developed with Van Lanschot Kempen. “Boards and their corporate head office teams should embrace the DB pension scheme opportunities the Chancellor’s initiative provides. All stakeholders benefit.” William McGrath William McGrath Chief Executive, C-Suite Pension Strategies T: 07768 607204 E: [email protected] TC Jefferson Chief Executive The Plenum Group & C-Suite Partner T: 07581 466620 E: [email protected] |

Archives

July 2024

|

C-Suite Pension Strategies Ltd

80 Coleman Street, London EC2R 5BJ

Registered in England and Wales

Company No. 09974973

80 Coleman Street, London EC2R 5BJ

Registered in England and Wales

Company No. 09974973

RSS Feed

RSS Feed