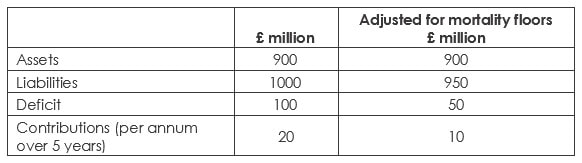

Indicative Calculation The balance sheet improves by £50 million pre-deferred tax. The P & L benefits by £50 million x the discount rate of a double A corporate bond. Comments are closed.

|

Archives

July 2024

|

C-Suite Pension Strategies Ltd

80 Coleman Street, London EC2R 5BJ

Registered in England and Wales

Company No. 09974973

80 Coleman Street, London EC2R 5BJ

Registered in England and Wales

Company No. 09974973

RSS Feed

RSS Feed