|

Rhetoric and Reality Keeping ESG Statements and Pension Policies Aligned Sponsors can make their pension schemes a worked example of their ESG strategies Boardroom Statements Board statements on ESG policies have become clear and committed. And often ambitious.

Trustee Statements Trustee statements in Statements of Investment Principles keep a safe distance as possible from ESG considerations. The Scheme’s journey plan to buyout provides a timetabling “get out” clause. Unless they can be considered directly financial, the views and interests of members are explicitly ignored by most trustee bodies.

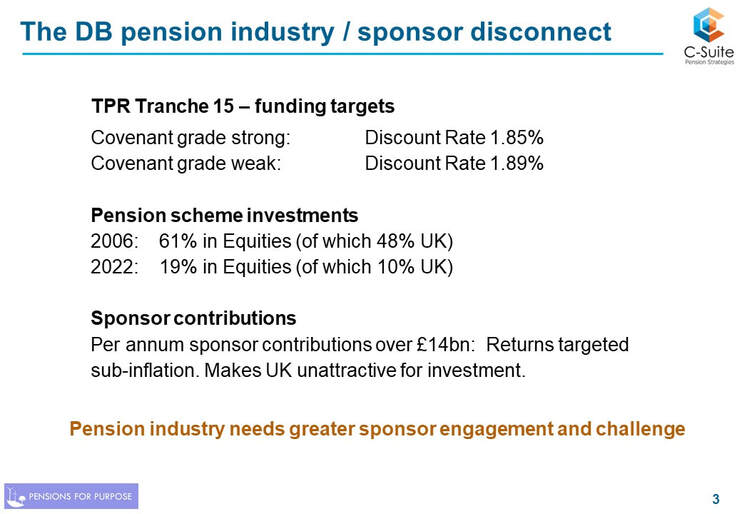

C-Suite Pension Strategies has looked into a number of corporates and their pension schemes. The gap is frankly wide between the corporate rhetoric on ESG and the trustee reality on pension funding. Contact us to discuss the findings. A new Boardroom led ethos reflecting its stated strategies would close the gap by giving trustees a modernised remit. End the endgame. Link the past to the future. All stakeholders benefit. Is Transferring a Scheme to a Life insurer Really in Members’ Best Interests? Questions and Answers Should sponsors be encouraged to stay?

Solvency II / longevity / inflation are uncertainties: Buyout now?Wait and see. Action now is a gamble on political decisions yet to be taken. Apart from weaker Solvency requirements, known information means longevity tables when updated will reduce liabilities. All round the costs of buyouts should fall.

Members should consider their position and revolt. The position of C-Suite Pension Strategies is that corporate sponsors need to “get stuck in”. The industry is not working in either their or in scheme members’ best interests. The 2004 Pensions Act introducing TPR and PPF was a success. Higher cash funding and derisking have left many schemes well placed. Schemes should now be revived on a modernised (C)DC basis. The trigger for change is the ESG commitment of Boards and the risks in greenwashing. Pension funding strategies provide excellent test cases of rhetoric against reality. At the same time members should revolt. With inflation higher than most scheme increase caps, then annuitisation is not a path to “peace of mind”. Overall “endgame” thinking is inappropriate. It is not the End: it is not a Game. A change in the premise of corporate sponsors to embrace from “get risk ASAP” can be transformational, showing how it is not too late for many sets of trustees to reengage with members and provide them with better outcomes. Comments are closed.

|

Archives

July 2024

|

C-Suite Pension Strategies Ltd

80 Coleman Street, London EC2R 5BJ

Registered in England and Wales

Company No. 09974973

80 Coleman Street, London EC2R 5BJ

Registered in England and Wales

Company No. 09974973

RSS Feed

RSS Feed