|

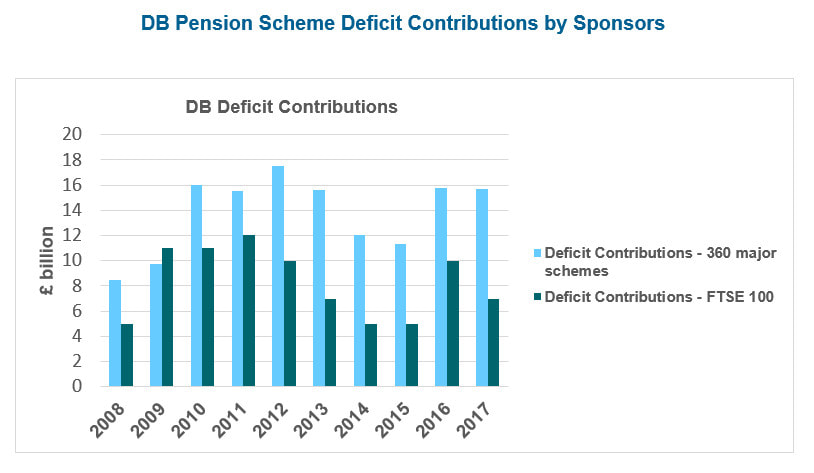

Money for investment is available by not over solving the pension funding question.

So:

Large sums are readily available to back investment in Britain. Comments are closed.

|

Archives

July 2024

|

C-Suite Pension Strategies Ltd

80 Coleman Street, London EC2R 5BJ

Registered in England and Wales

Company No. 09974973

80 Coleman Street, London EC2R 5BJ

Registered in England and Wales

Company No. 09974973

RSS Feed

RSS Feed