|

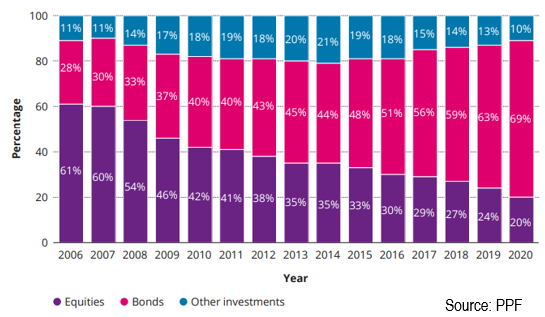

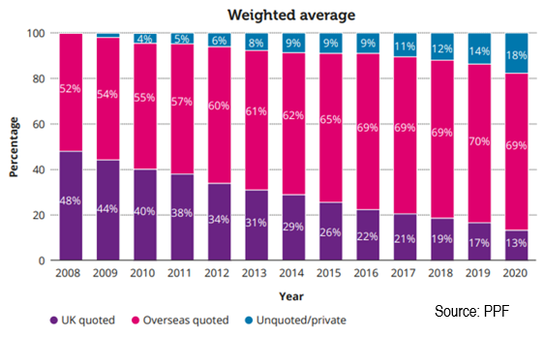

£14bn has been spent every year for over a decade to fund Defined Benefit (DB) pension scheme deficits. £30bn of pension liabilities were transferred last year to the booming life insurers. Why? Because derisking is seen as good and the pension regulators are intimidating. But are better outcomes possible? What if the sector’s “Gold Standard” of life insurance annuitisation is like the Gold Standard of the 1920’s and just an economy distorting bad idea. What if, by seeking to fill up pension black holes, we have actually already created magic money trees. If so, perhaps we should help them grow. Environmental, Social and Governance inspired directors could review their strategy to find out. Perhaps it’s time to take your time with the DB Pension Scheme. Hold on tight to a steady, low risk approach to pension funding; focus on the actual cash required and, as actuarial prudence trues up, very many schemes will have more than enough resource. The question then is how best to divide the cake. But first, where are we now? We are in a better place than we acknowledge. The Pension Act 2004 set up the Pension Protection Fund (PPF), raised regulatory standards and forced up contribution levels. A triumph is that the PPF is really quite small after 15 years and is very well funded. But high profile corporate failures inspired the new Pension Schemes Act 2021. It has a toughened up The Pensions Regulator who is ready to finish the derisking job. Fair enough unless the sponsor offers an alternative bespoke solution. Responding to all these pressures, investment derisking continues. Back in 2008 54% of money was in equities and 33% in bonds. Now its 20% and 69%. Further, UK equities are now just 13% of the reduced portfolio down from 48%. No help for the UK economy then. UK indexed linked gilts - that’s the expensive asset class of choice. The priority given to funding DB schemes has consequences. Provision for current employees is at much lower levels and is now on a Defined Contribution basis. The corporate takes no continuing investment risk. Many companies pay far more to supplement DB members than they spend on their current workforce.

“Get rid” is all pretty explicable – particularly where the owners are foreign groups who bought UK businesses dimly aware of DB pensions. It’s hard to make UK investments a priority when the concern is that the “legacy” pension schemes take most of the cash generated. So now the winners are fixed income sales teams and life insurers. And there is a well formulated “fast track” coming along from The Pensions Regulator to provide more of the same. Current employees and investment levels in UK plc need an alternative way forward. We can redirect resources and build on the timely caution of recent years in the pension sector. All this is possible. Using the DB Pension scheme magic money tree will result in benefits for all stake holders. Comments are closed.

|

Archives

July 2024

|

C-Suite Pension Strategies Ltd

80 Coleman Street, London EC2R 5BJ

Registered in England and Wales

Company No. 09974973

80 Coleman Street, London EC2R 5BJ

Registered in England and Wales

Company No. 09974973

RSS Feed

RSS Feed