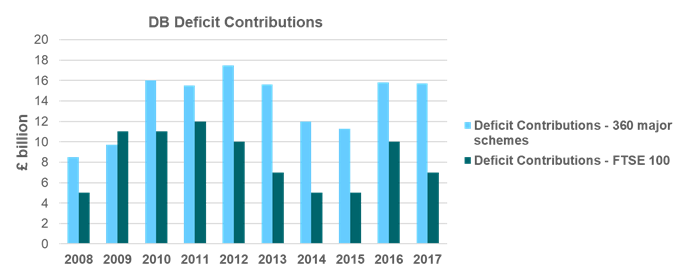

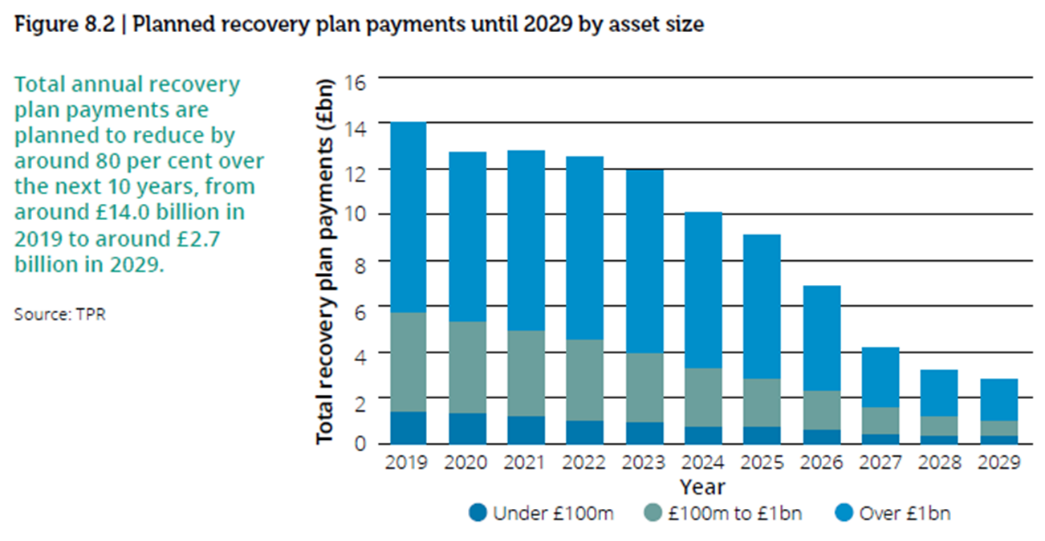

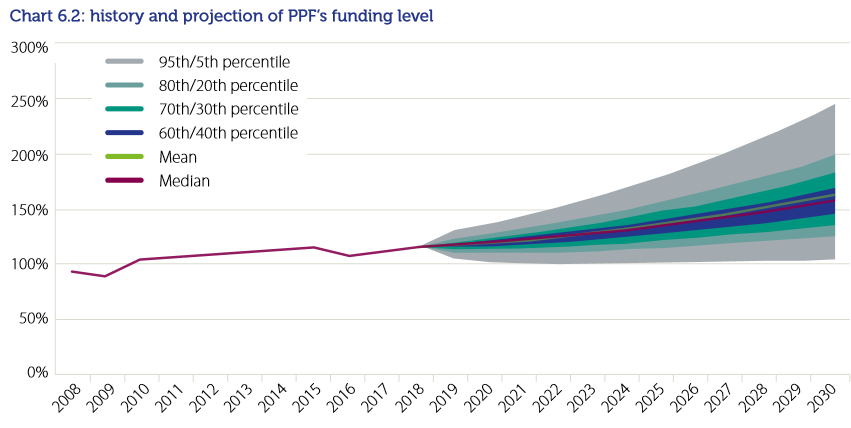

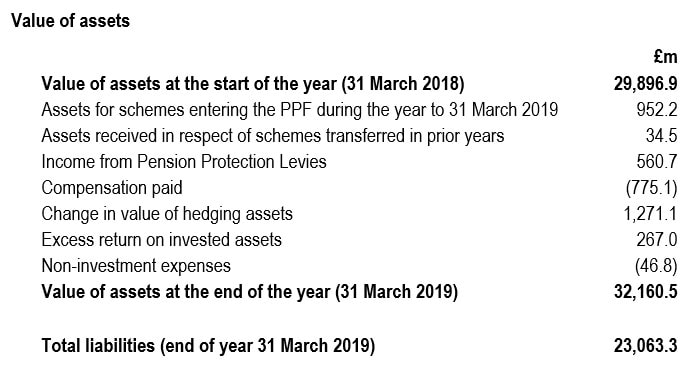

1. Defer agreed pension deficit contributions by 12 months, due in the year to April 2021. Consequently, all subsequent payment dates move forward by a year. This adds £13 billion to UK corporate liquidity in 2020 / 2021. If any sponsor subsequently does not make the payments then due in the year April 2021/2022 and enters an assessment period with the Pension Protection Fund, there will be a State Guarantee of that deferred amount payable to the scheme. This structure should ensure the Guarantee is not State Aid granted to the sponsor. Sponsors / trustees should consider third party, risk diversifying, payment guarantees from banks / insurers to back this deferral and/or longer term rearrangements of recovery plans. The deferral enables The Pensions Regulator to respond to its statutory obligation in respect of the sustainable growth of employers. DWP/TPR can take the initiative and state they will support company / sponsor agreements to make such deferrals. They would expect the parties to consider dividend payment levels to ensure fairness to all stakeholders. TPR should also ensure that the proposed 2021 Pension Funding Code takes account of changed economic circumstances created by Covid-19. Approximately £140bn in DB pension scheme deficit contributions have been made by 360 major UK schemes in the 10 years to 2017 Contributions do not take account of the more stringent Long Term Funding Objectives required under the new Pension Funding Code 2. Pension Protection Fund suspends the levy for a year saving sponsors £550 million. The PPF is successful and strong financially with a substantial buffer within its £32bn asset base. The investment strategy and a much improved financial position of most defined benefit pension schemes means that its business model is profitable. It can reset its low dependency target date to 2035 rather than the current 2030. A year without levy contributions would not introduce material additional financial risk. An immediate policy focus should be on preventing schemes falling into the PPF because of Covid-19. A levy suspension helps. (Source PPF Funding Strategy Update 2018) (Source PPF Annual Report and Accounts 2018/2019) Related liabilities are £23bn. Schemes currently in assessment are considered to have a deficit of £3bn using a conservative basis on assets of £6bn.

Comments are closed.

|

Archives

July 2024

|

C-Suite Pension Strategies Ltd

80 Coleman Street, London EC2R 5BJ

Registered in England and Wales

Company No. 09974973

80 Coleman Street, London EC2R 5BJ

Registered in England and Wales

Company No. 09974973

RSS Feed

RSS Feed