Run On 4 Good : Benefit All Stakeholders

Respond positively to Government's policy reset.

Now assess a proposal to embrace the role as long term sponsor and ensure the scheme supports Group's S172 Statements and ESG commitments

Respond positively to Government's policy reset.

Now assess a proposal to embrace the role as long term sponsor and ensure the scheme supports Group's S172 Statements and ESG commitments

As the Board considers employee loyalty, wage inflation and its ESG ethos, adopt a modern C-Suite Pensions Strategy to:

The impact can be transformational. Better direction of resources brings great positive impacts at less cost. Embrace the Collective Wealth Fund.

Steps to Implement:

Agree an Integrated Risk Management plan with the trustees with new Trust Deed and Rules introducing a new (Collective) Defined Contribution tier. It sets out when excess cash can be allocated on a discretionary basis to the pensions of former and current employees. Deal with inflation’s impact on pension values.

Agree a FiduciaryPlus contract. It sets a long term, low risk, fixed income led asset management framework. It matches the real cash payments against a good quality member database. It contains a guaranteed sum from a third party financial institution covering the remote risk of the sponsor’s failure.

Update Statements of Investment and Funding Principles to incorporate sponsor ESG commitments and member preferences.

Update employment terms. Pension provision can again be a key feature for HR in staff recruitment and retention. A competitive advantage in a changed employment environment.

Reassess the Governance. The sponsor’s nominees have a key role in a policy reset away from annuitisation as the “endgame”. They can demonstrate that long termism works for all stakeholders.

Boards can replace the DB pension “get rid” mindset with a forward looking “run on” policy which works for sponsors, pensioners, employees and shareholders as Government policy wants.

An ESG flagship benefits all stakeholders.

Take a new look at DB pensions. Run on 4 good.

- Run on long term

- Introduce modernised tier for today’s employees

- Recycle surplus cash to benefit current and past employees

- Align investment strategy for scheme funds with sponsor’s publicly stated ESG objectives. Make impact and place-based investment a growing feature

The impact can be transformational. Better direction of resources brings great positive impacts at less cost. Embrace the Collective Wealth Fund.

Steps to Implement:

Agree an Integrated Risk Management plan with the trustees with new Trust Deed and Rules introducing a new (Collective) Defined Contribution tier. It sets out when excess cash can be allocated on a discretionary basis to the pensions of former and current employees. Deal with inflation’s impact on pension values.

Agree a FiduciaryPlus contract. It sets a long term, low risk, fixed income led asset management framework. It matches the real cash payments against a good quality member database. It contains a guaranteed sum from a third party financial institution covering the remote risk of the sponsor’s failure.

Update Statements of Investment and Funding Principles to incorporate sponsor ESG commitments and member preferences.

Update employment terms. Pension provision can again be a key feature for HR in staff recruitment and retention. A competitive advantage in a changed employment environment.

Reassess the Governance. The sponsor’s nominees have a key role in a policy reset away from annuitisation as the “endgame”. They can demonstrate that long termism works for all stakeholders.

Boards can replace the DB pension “get rid” mindset with a forward looking “run on” policy which works for sponsors, pensioners, employees and shareholders as Government policy wants.

An ESG flagship benefits all stakeholders.

Take a new look at DB pensions. Run on 4 good.

Start with the Risk-Benefit Assessment

Take a New Look at DB Pensions as ESG Flagships with the C-Suite Team

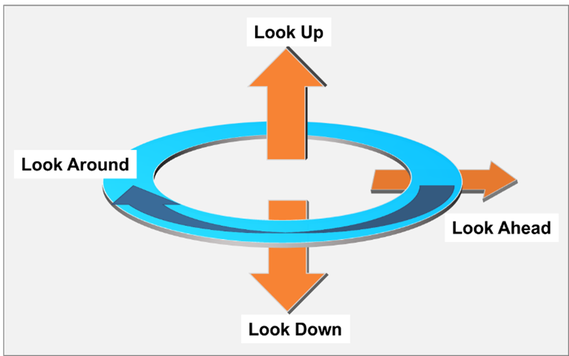

Look Up |

Agreed added discretionary, self limiting pension payments for past and present employees. Scheme to cover costs currently paid by sponsor Have Scheme Rules permitting surpluses to be used to fund new (C)DC scheme tier and raise pensions in a manageable way (Use the C-Suiteps Analytics model) Have framework in place for return of surpluses to sponsor over time and of legal and tax rates change. |

Look Down |

Assess the growing proportion of liabilities covered by PPF as part of updated risk assessments by the Integrated Risk Committee (Use the C-Suiteps Analytics model) Look to insurance markets to cover sponsor solvency risk and insure sponsor against further cash calls. |

Look Ahead |

Reset Statement of Investment Principles to embed long term stability not “death wish” endgame. Create ESG Flagships aligning trustee and sponsor attitudes. Have time to wait for prudence in life expectancy and demographic assumptions to true up. |

Look Into |

Technical Actuarial Standard 300 2.0 requires buyout / run on comparison by actuaries. Obtain the analysis. |

Look Around |

Governance check to ensure trustees have meaningful roles and IT / admin systems are fit for purpose. Respond to the new public policy post Mansion House Autumn Statement and DWP Pension Consultation. Ask actuaries for the TAS300 v2.0 assessment. |

Look out in all directions for your pension scheme

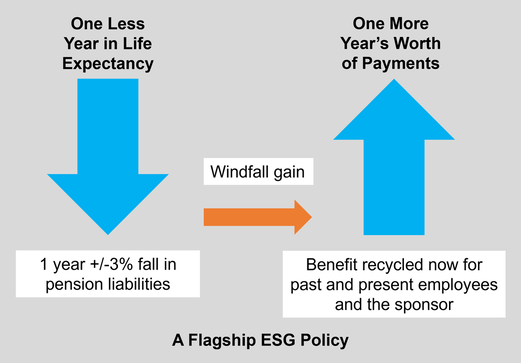

Government is consulting on the use of surpluses. life expectancy assumption reductions provide a worked example of when discretion can be exercised

One Less. One More

A Flagship ESG Initiative

One Less. One More

A Flagship ESG Initiative

An Exercise in Discretion to Benefit All Stakeholders

Campaign for One Year Less on life expectancy to mean One More Years worth of pension related payments for past and present employees

Backdrop

Life expectancy assumptions are coming down further in actuarial tables. Liabilities will fall by over 3% for most DB schemes. Current annual payments to pensioners represent typically over 3% of assets after recent falls in value (and greater falls in liabilities for the better financially managed).

Trustees and sponsoring employers can decide to distribute additionally benefits to past and present employees in response to changed information. This is a straight improvement to the scheme’s finances. The assets are not affected by the assumption changes – as happened when interest rates increased.

But C-Suiteps Analytics show that the buyout case collapses for scheme members when there are surpluses available.

Proposal

The benefit of discretionary payments can be split. Increased payments can be made directly to past and present employees. These comply with tax and legislative requirements. C-Suite has worked through the detailed requirements. Sponsoring companies can also benefit from reduced contributions.

The principle of exercising discretionary payments is established.

Campaign Objectives

The objective is to help past and present employees in the tough current economic circumstances. The over funding of pension liabilities makes this practical. That results in having a long term investment strategy for the scheme and having a modernised tier within it.

Pension scheme members and current employees can put the case to sponsors and trustees for “one less one more”

HR as well as finance teams of corporates should take up the opportunity. Here is a break point where intergenerational unfairness is on the agenda and there is an action plan. Member nominated trustees are particularly relevant.

Scope to Exercise Discretion is there. Use it.

The principle of exercising discretionary payments is established.

Campaign Objectives

The objective is to help past and present employees in the tough current economic circumstances. The over funding of pension liabilities makes this practical. That results in having a long term investment strategy for the scheme and having a modernised tier within it.

Pension scheme members and current employees can put the case to sponsors and trustees for “one less one more”

HR as well as finance teams of corporates should take up the opportunity. Here is a break point where intergenerational unfairness is on the agenda and there is an action plan. Member nominated trustees are particularly relevant.

Scope to Exercise Discretion is there. Use it.

Time for Corporate Sponsors to Embrace DB Schemes as ESG Flagships

The “Get Rid” Presumption is Replaced with Revitalise Now

The “Get Rid” Presumption is Replaced with Revitalise Now

The Risk Transfer Industry case is that corporates just want out. The patronising line of “leave it to me and you can concentrate on your core activity” is repeated regularly. But does it stand up to analysis? And is it what Government now wants to see?

The Risk Transfer Industry case is that corporates just want out. The patronising line of “leave it to me and you can concentrate on your core activity” is repeated regularly. But does it stand up to analysis? And is it what Government now wants to see?

Chair and CEOs want to concentrate on core corporate activity |

ESG Statements and Sustainability Reports make clear that environmental and societal issues head the governance agenda. Pensions are core and part of DNA : not a distraction. |

Scheme is shut to new members |

Shut on one basis; revitalised and reopened on a modernised DC basis. New legislation to assist in the "recycling" into new established DC tier arrangements. |

Endless cost and volatility |

Volatility and contribution levels are well understood and under control after nearly 20 years work with TPR. It is time to update thinking. Start with schemes paying all the costs. Plan to eliminate all DB and DC costs from company accounts and have P/L credits. |

Investor indifference |

Not any more. Pensions can provide a boost to markets when a gilts fixation ends. As ESG / Impact funds see their remit as relevant to updated pension fund thinking. Surpluses are available to fund DC commitments, raising company cash returns. There will be real interest from investors on reputational and financial counts in the new mindset. |

No financial upside |

Surpluses will emerge that can be used to fund DC contributions and bring surplus repayments. Earnings and cash benefits will materialise and financial market and ESG rating will improve. Markets will establish upward momentum. |

Time / administration / employee disinterest |

With new timeframes set there is a reason to look at the governance (including the trustee structure) and the admin of the scheme – areas in which the major consultancies have under-invested. Better systems will be a material boost as funds flow into productive assets. As schemes reactivate and current pension provision is a topic linked to DB schemes, so the level of interest amongst relevant current employees will quickly recover. |

Government and Regulatory pressures |

HM Treasury and DWP letters to TPR / FCA state changed public policy. Alternatives to derisk / buyout are encouraged. Strong upside is expected. |

Pensions : Board Assessment of "Run On 4 Good"

Pension Reassessment on the Board Agenda

Pension Reassessment on the Board Agenda

Proposal for the Board

Boards back a “run on” strategy for DB schemes. Aim to benefit all stakeholders and it aligns corporate and trustee ESG statements. New, long term target set of all pension costs for past and present employees being paid for by the scheme.

Update

Much changed Government and Regulatory background post the LDI crisis. Mansion House and Autumn Statement state “Productive assets” investment by large pension schemes are to be encouraged. Government backed Technical Actuarial Statements requires run on analysis to be in place ahead of buyouts.

Consultants muse on radical policy overhauls while protecting lucrative risk transfer businesses.

Key Factors

Conclusion

Balance of risk / reward has changed.

Exit has opportunity costs and reputational risks. Engagement brings opportunity, addresses greenwashing and works well with Government restated public policy expectation. Run on will bring new investor interest.

Boards back a “run on” strategy for DB schemes. Aim to benefit all stakeholders and it aligns corporate and trustee ESG statements. New, long term target set of all pension costs for past and present employees being paid for by the scheme.

Update

Much changed Government and Regulatory background post the LDI crisis. Mansion House and Autumn Statement state “Productive assets” investment by large pension schemes are to be encouraged. Government backed Technical Actuarial Statements requires run on analysis to be in place ahead of buyouts.

Consultants muse on radical policy overhauls while protecting lucrative risk transfer businesses.

Key Factors

- Risk transfer transactions have been and still are extremely costly in an overheated market. Opaque pricing and the risk of information asymmetry make life insurers and related consultants vulnerable. Ask for a track record.

- New finance products available to cover off residual risks to trustees and company (surety and contribution cover).

- Existing legal and regulatory pension framework provides flexibility needed to make discretionary payments and fund current DC pensions.

- Past concerns about volatility, cost and distraction are diminished and modest compared to ESG and financial returns.

- Re-involving HR in setting up a new (C)DC pension tier can bring recruitment and retention benefits.

- Investors / stockbrokers are starting to recognise the significance of large pension asset pools. Can link to UK stock market rerating if derisking processes end and productive assets and DC tier grow.

- Pension reset to create ESG Flagships can bring share price rating pickup (ESG and EPS driven): Reputationally enhancing: Can help HR.

- Strong corporate narrative established.

- Mansion House / Autumn Statement reset expectations to run on for strong sponsors.

Conclusion

Balance of risk / reward has changed.

Exit has opportunity costs and reputational risks. Engagement brings opportunity, addresses greenwashing and works well with Government restated public policy expectation. Run on will bring new investor interest.

Why not commission a brief report to compare Run On 4 Good with the Endgame plan.

It will be game changing.

Contact us runon4good@c-suiteps.com

It will be game changing.

Contact us runon4good@c-suiteps.com

Watch FD Carol Animations to see how running on benefits all

Watch FD Carol Animations to see how running on benefits all