William McGrath, founder of C-Suite Pension Strategies suggests LDI problems should inspire scheme trustees and members to consider some awkward questions.

Awkward Questions

Awkward Questions

- What has been sold and at what losses in the last month to meet LDI collateral calls? How large were those calls?

- Is leveraged LDI legal?

- Who agreed the terms for the collateral calls: quantum, timing and waterfall asset sale plans?

- Buyins are assets of the scheme. What are they worth priced today? What were the interest rates and mortality assumptions embedded in deals in recent years?

- In what circumstances could members see their pension improve on a discretionary basis?

- Given enthusiastic ESG commitments how can sponsors take a more engaged role in their DB scheme and all stakeholders have an upside from doing so? Are trustees committed enough to the ESG agenda?

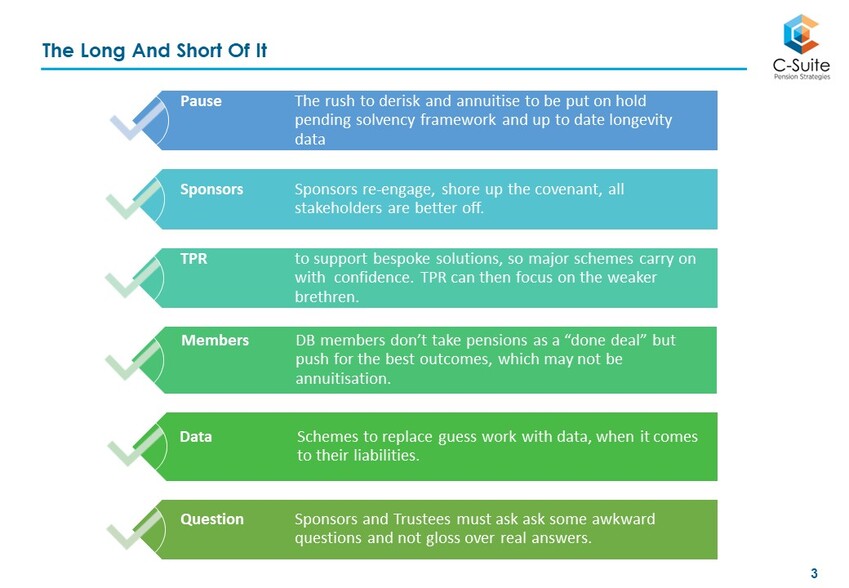

We raised these questions at the Pension Playpen Coffee Morning on 18th October asked if it is now time for a longer term outlook in UK pensions

|

Run that LDI past me again......

|

How to grow a magic money tree

|

We believe strongly that better journey plans are available for UK pensions and we explained our thinking in our letter to the Pensions Minister, Alex Burghart.

There is a better way.

Risk transfers are not compulsory

Speak to us for a modernised strategy for pension provision

[email protected]

[email protected]

Risk transfers are not compulsory

Speak to us for a modernised strategy for pension provision

[email protected]

[email protected]