Pension Funding : The Bespoke Solution

New Rules Require a New Direction

The Pension Schemes Act 2021 and The Funding Code Consultation set demanding targets, give The Pensions Regulator more powers and require more cash from the Sponsor.

The ‘Fast Track’ bottom line is more money ASAP from sponsors, unless, you provide a ‘Bespoke Solution’ for funding your pension scheme.

The Code provides you with the opportunity to respond positively and take decisive action.

Let us model now the best bespoke options for you, using financial guarantees to drive ‘what if’ scenarios and flex the key assumptions.

C-Suite Pension Strategies can model the best bespoke options and devise a plan specifically for you. Our plan involves a Pension Sufficiency Guarantee. This allows schemes to generate higher returns resulting in less cash contributions required from the sponsor. We work with asset managers who have a full appreciation of the scheme's cash generating capacity and actual cash payment profile.

We use the modelling capacity of Moody's Analytics PFaroe software to prepare the bespoke solution.

The ‘Fast Track’ bottom line is more money ASAP from sponsors, unless, you provide a ‘Bespoke Solution’ for funding your pension scheme.

The Code provides you with the opportunity to respond positively and take decisive action.

Let us model now the best bespoke options for you, using financial guarantees to drive ‘what if’ scenarios and flex the key assumptions.

C-Suite Pension Strategies can model the best bespoke options and devise a plan specifically for you. Our plan involves a Pension Sufficiency Guarantee. This allows schemes to generate higher returns resulting in less cash contributions required from the sponsor. We work with asset managers who have a full appreciation of the scheme's cash generating capacity and actual cash payment profile.

We use the modelling capacity of Moody's Analytics PFaroe software to prepare the bespoke solution.

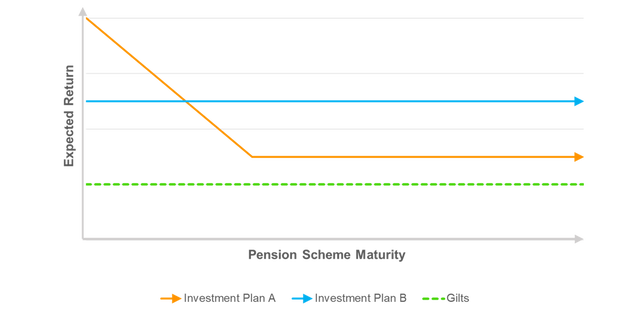

Pension Sufficiency Guarantee

Over time, higher asset returns fill the gap to self-sufficiency.

Investment plan A - standard investment derisking plan

Investment plan B - New investment plan with guarantee in place - flat line

Investment plan A - standard investment derisking plan

Investment plan B - New investment plan with guarantee in place - flat line

Derisk the covenant : Revamp the investment strategy : Cut cash contributions : Reactivate to benefit all stakeholders