|

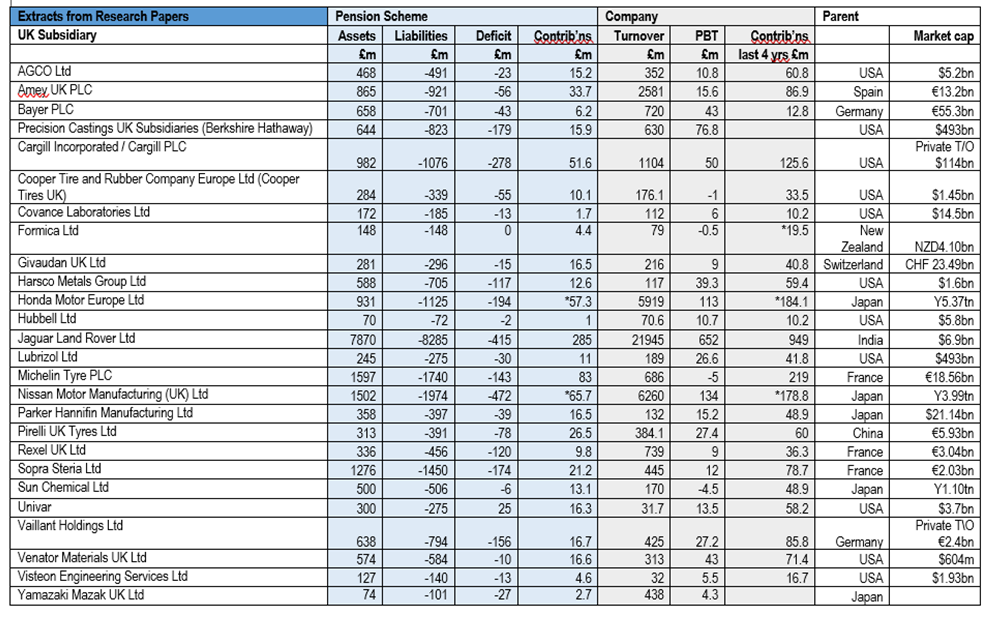

International Groups : UK Subsidiaries Pensioning Off UK Industries

There is a solution The answer is for the Group to ‘get stuck in’ and provide a structure under which it, its subsidiaries and members of the scheme are all properly protected. This is achieved by the Group agreeing to keep in place guarantees from financial institutions which diversify any risk to the scheme. They cover the gap between the assets held today and the amount needed for the scheme to be self-financing. The agreed guaranteed framework remains in place until that is achieved. In exchange, the scheme maintains an investment strategy which has less derisking and requires lower cash contributions. All stakeholders benefit For more information contact: William McGrath Chief Executive C-Suite Pension Strategies Former CEO Aga Rangemaster E: w.mcgrath@c-suiteps.com Roger Higgins C-Suite Partner Former Partner and Actuary with KPMG E: r.higgins@c-suiteps.com Alan Baker C-Suite Partner Former DB Risk Leader at Mercer E: a.baker@c-suiteps.com Comments are closed.

|

Archives

April 2024

|

C-Suite Pension Strategies Ltd

80 Coleman Street, London EC2R 5BJ

Registered in England and Wales

Company No. 09974973

80 Coleman Street, London EC2R 5BJ

Registered in England and Wales

Company No. 09974973

RSS Feed

RSS Feed