|

In the post BHS/Carillion world the Government and its regulating bodies are introducing a host of new rules and expectations of defined benefit pension schemes. The most important change is that The Pensions Regulator now wants the scheme to be funded to self-sufficiency or to buy-out levels. That means, if the scheme’s assets are not giving the returns required, the company will have to fund the shortfall in cash.

This places the company in a difficult position. If it turns down the trustees’ request for cash then it can come under pressure from the newly powerful Pensions Regulator:

The Finance Director still needs to allocate capital effectively and look after all interested parties i.e. the company, members of pension scheme, shareholders and current employees. Further, there are governance issues to be readdressed about how Boards set pension policy. The Pensions Regulator will drive the trustees of pension schemes towards aligning with buy-out funds and advisors’ thinking supports derisking all the way. C-Suite Pension Strategies has prepared a proposal which turns the current thinking on its head. It allows companies to provide new money for the scheme, increase investment returns and reduce cash demands. The C-Suite Proposal:

There are other issues to consider. The improvement in pension funding position this year will be encouraging trustees to look for more derisking but similarly, the cost of insuring self-sufficiency is achieved will also now be lower. The investment strategy may need a review. The recent Competition and Markets Authority review, called for more competitive tenders from investment management contracts. Those factors make it a good time to consider the best available investment and fiduciary offerings. We can look at the position for any pension scheme and from those basic numbers can work out what proposal should work for all parties. Our proposal can help you manage your capital and renegotiate your contribution pattern. We are partners to some of the leading consultants engaged with pension funding issues who are ready to devise and implement proposals. We will review your current position and look at how to use Sponsor Contribution Insurance as one of your bargaining tools. Cash contribution levels are part of the discussions. By offering something tangible and new, the company takes the initiative and trustees will need to review their priorities. You can achieve a great deal without overuse of the cheque book. Reputational risks, governance and rising cash costs mean pension funding should make Boardroom Agenda this autumn. The Government consultation on creating a “Stronger Pensions Regulator” means that directors of companies with final salary pension schemes to fund can have no doubt who’s responsible if things go wrong? If dividends are paid; transactions undertaken; financing strategies set without reference to pension funding; then reprimands, fines and custodial sentences are all possible.

Further, the Pensions White Paper spells out journey plans that move beyond today’s actuarial deficit numbers to self-sufficiency and buy-out. Given the relentless derisking moves by schemes’ trustees, that can only mean more money from the company. And post BHS and Carillion, directors need to consider personal and corporate reputations. As with taxation, so now with pensions, being good at minimising the bill may not be a virtue. Is managing down pensions payable really what you should do even if you can? Leaving it to the finance directors and pension advisors to deal with funding discussions may have been fine. But whether you are a UK PLC; private equity owned business or a subsidiary of a global major, who wants to be the person or the advisor that is arguing with the trustees or The Pensions Regulator against shorter recovery plans or against derisking investment portfolio? Certainly, it’s only fair for Boards to provide clear instructions. That’s all before pension funding is factored into strategy sessions. How does a Board argue against an offeror able to provide greater security for pension scheme if the Board cannot match it? To do so on the grounds that the value of the equity is not enough is tricky if you read through the consultation paper. In assessing transactions as offeror or offeree, pensions is worthy of Boardroom airtime. With your current journey plan, even damage limitation strategies are difficult to implement when improved funding positions simply mean that you derisk faster and trustees ring bulk annuity providers. Right now, the trustees have the moral high ground; well-armed and trained advisors and new, super powered support from The Pensions Regulator. So the problem statement has plenty of sub clauses. And the answer? You need to move to a defensible position. That means underwriting self-sufficiency if the trustees keep to an agreed investment that can get your scheme there without just asking for more cash. Banks and insurers will provide the back-up pension schemes want. Plenty of detail to work through and it can be done. But for the Board, the policy decision should be, in light of Government changes to the regulatory framework, it adopts a new tenable position that reiterates the commitment to all stakeholders. That’s how to stop pension funding being too frequently a Boardroom agenda item. “Given the Government expectations and the financial and reputational risks that brings, Boards should be ready to change their approach decisively. Underwrite now the scheme’s journey to financial self-sufficiency. In exchange the scheme should have an investment strategy to get there without you.” William McGrath - CEO C-Suite Pension Strategies Logic

Action C-Suite Pension Strategies links sponsors with:

Advantages

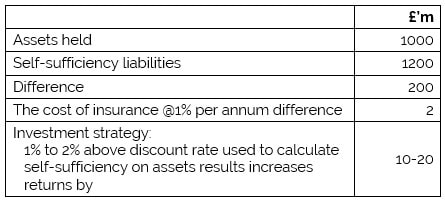

Impact Illustrative numbers show immediate cash benefits: The investors; the Board; the pension scheme members and the trustees have clarity about the plan and can see it working for all parties.

|

Archives

April 2024

|

C-Suite Pension Strategies Ltd

80 Coleman Street, London EC2R 5BJ

Registered in England and Wales

Company No. 09974973

80 Coleman Street, London EC2R 5BJ

Registered in England and Wales

Company No. 09974973

RSS Feed

RSS Feed