|

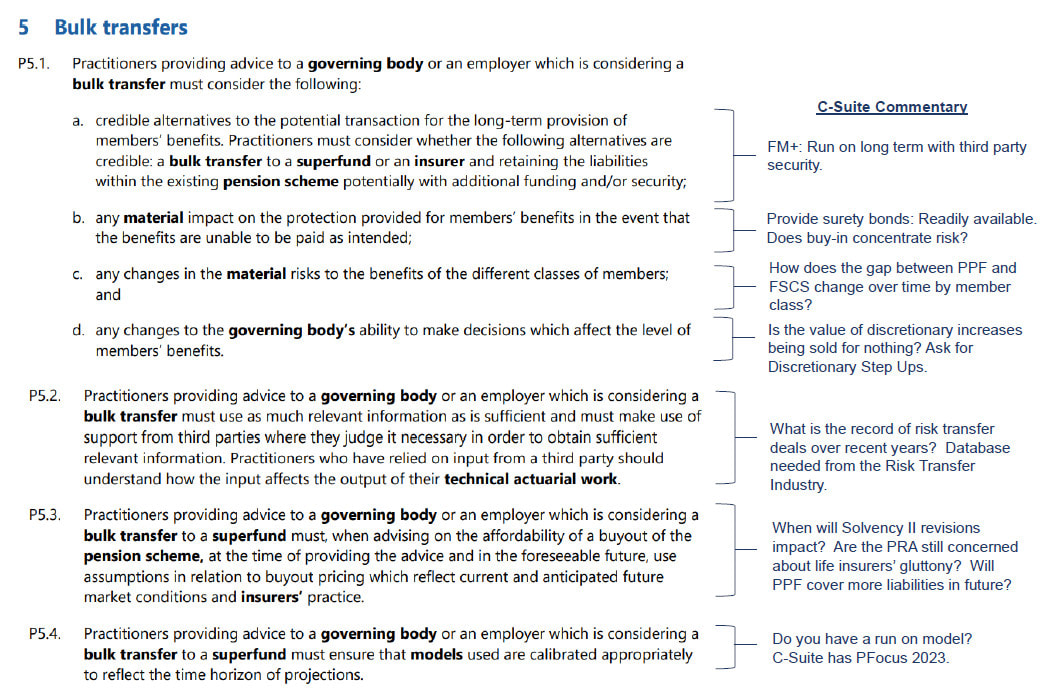

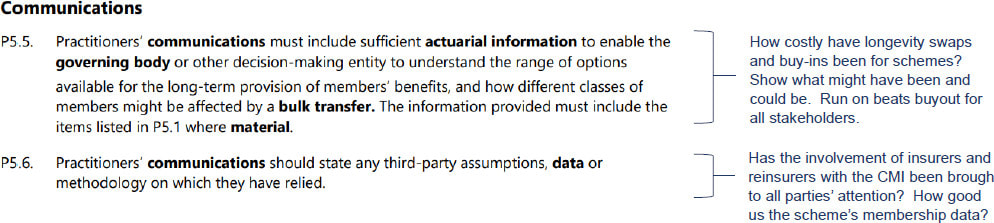

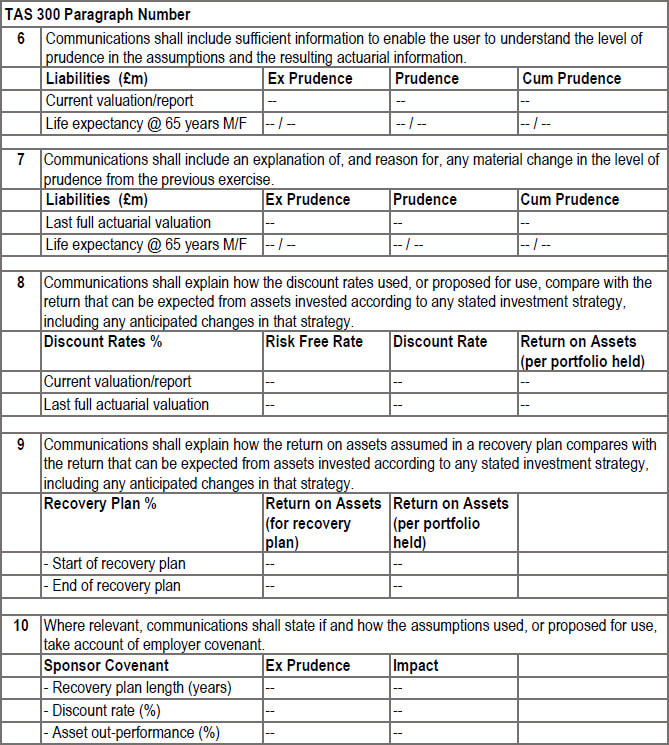

TAS300 2.0 has written C-Suite's “run on” strategies into regulation. The revised Technical Actuarial Standard 300 says that ahead of bulk transfers actuaries must consider “retaining liabilities in the existing pension scheme potentially with additional funding and / or security”. That’s what C-Suite has been advocating for 5 years and developed with Van Lanschot Kempen into FM+. TAS300 2.0 should mean trustees and members can expect less presumption and more analysis about what is in their best interests from their actuaries. Is run on a better option when there is third party back up? How much of my pension is covered by the PPF? Is the chance for discretionary increases being sold for nothing? What is the track record of risk transfer transactions? How good are disclosure levels? Are exclusive deals with life insurers a good idea? Perhaps now actuarial consultants should be less squeamish about providing data on deals they have enthusiastically supported. And the idea that any price which beats actuarial model assumptions and is affordable is a good price will come under scrutiny. TAS300 was an excellent standard when introduced in 2017. Its weakness was that many actuaries ignored the substance and glossed over it. Now with Government setting a new agenda, scheme members and trustees should be more demanding and question what is best. The Risk Transfer industry should be more specific about how many carats the Gold Standard provides. But will actuaries help the revised TAS300 stick? C-Suite Pension Strategies’ Response to the Financial Reporting Council’s Consultation on TAS 300 Question 1 TAS 300 is sound and an impressive document. As the Consultation Paper notes, it is the rise of risk transfers since its introduction which needs specifically addressing. The weakness of TAS 300 is in patchy compliance. Interested parties, including scheme sponsors, members and trustees, may not realise what should and could be provided. TAS 300, when it came into force in June 2017, could have been a major step forward. It was well thought through and written. The major actuarial consultancies would appear to have glossed over or ignored its requirements. C-Suite Pension Strategies produced in 2017 a summary of key information that TAS 300 disclosures might have been expected to produce . See table below. Actuarial work stated to be compliant with TAS 300 should be tied back to relevant numbers. Where the information is linked to risk transfers rather than course correction over the long term, the need for compliance is greatly heightened. The central estimate and the level of prudence included should be more clearly set out. An example of particular current relevance is with life expectancy. When longevity assumptions include debatable and judgemental weightings for years and the CMI data does “not speak for itself”, the level of prudence should be clear when value is being transferred. Question 2 The decision to defer changes to TAS 300 is sensible given other recent and current consultations and calls for evidence. That delay might be accompanied by a stated raised expectation on compliance with the existing version. Question 6 An area where there could be new actuarial work to be carried out is in relation to discretion. TAS 300 reporting should consider the value of discretion as an actuarial factor. Most schemes have a discretionary power to raise or augment pensions. Actuarial work should note it and that trustees have confirmed with the sponsor whether there are circumstances envisaged in which the sponsor would support the use of discretion. In inflationary times this emerges as a relevant consideration. TAS 300 compliant actuarial work is then confirming the downside risk and upside potential of the scheme for members. For decision makers assessing bulk transfers there should be an available database of earlier deals. The rapid rise of the risk transfer industry means actuarial work has to ensure that there is symmetry of information between parties. A lack of transparency about actual transactions and their impact should be a major sector issue. The impact of the risk transfers undertaken to date on a scheme in actuarial terms is difficult to trace. The proposal is that the actuarial work should:

The data from a central database, perhaps best kept by PPF, should be made available to the actuarial consultancies advising schemes on risk transfers and to sponsors. TAS 300 data should inform IAS19 disclosures. Data on scheme specific risk transfer transactions can be available to sponsors for inclusion in sponsor’s statutory accounts. Information provided to comply with IAS19 S135, S136 and S146 is often broad brush. Scheme specific information included in Statutory Accounts can be informed by reference to the wider transaction data made available by the risk transfer database. This will show the impact of longevity, inflation and interest rates on deals. Break down of values often shown as hash compilation numbers in OCI and summary notes, can then be explained. The financial impact of transactions can be far more transparent. TAS 300 needs actuarial consultancies to comply as much as to be changed. The rise of the risk transfer market means the importance and quality of the data provided needs to be higher. “All risk transfers to a regulated insurer are good” has been a sector presumption. Prudence levels need explanation. Prudence should not be used as a cover for a lack of quality in databases of the scheme. The level of demographic and individual data available should mean assumptions on numbers married, for example, should be held as empirical data. Question 9 Risk transfer exercises should require a good risk analysis with numerical backing. Actuarial work - providing trustees and members with data to enable them to analyse the impact of risk transfer transactions - should now include a calculation of the gap between full pension payments covered by the Financial Services Compensation Scheme and by the Pension Protection Fund. The starting point to support risk transfers is the risk of “poor outcomes” for members. As scheme mature and more members are retired and with Court decisions on “tall poppies” in the Hughes and Hamilton cases the proportion of total payments rise that are PPF covered. An assessment of the economic real risk being run should be standard. The difference is now largely linked to inflation rates and potential increases. The calculation should also highlight how the gap reduces over time as payments to members are made. What is the risk of sponsor failure in a given timeframe should be addressed given its financial status. Just as PPF is interested in “PPF Drift” so should members and their advisors have a clear idea of what they are losing without PPF coverage – a well run, well financed, fully tested safety net with access to diverse sources of finance in extremis. Question 10 The consultation rightly noted that, with market changes since 2017, a vibrant successful risk transfer market has developed. It should mean some analyses provided are upgraded because of their lasting economic impact on the scheme. Technical Actuarial Standard 300 : Pensions Key Number Checklist Technical Actuarial Standard 300: Pensions was issued in December 2016 by the Financial Reporting Council. It applies to technical actuarial work after 1st July 2017. Actuaries want more and more cash from companies to fund the pension scheme deficits they calculate. But how much of it is cash for caution? Under TAS 300, the actuary now has to supply this information and so the Finance Director can challenge prudence. Ensure your actuary has filled in these numbers before you next meet. Now you can shine light in on actuarial magic. Government has written to tell the CEOs of The Pensions Regulator and Financial Conduct Authority to “encourage alternatives to derisking and buyout”. C-Suite’s theme that “Run On Pays Off for all stakeholders” aligns with public policy.

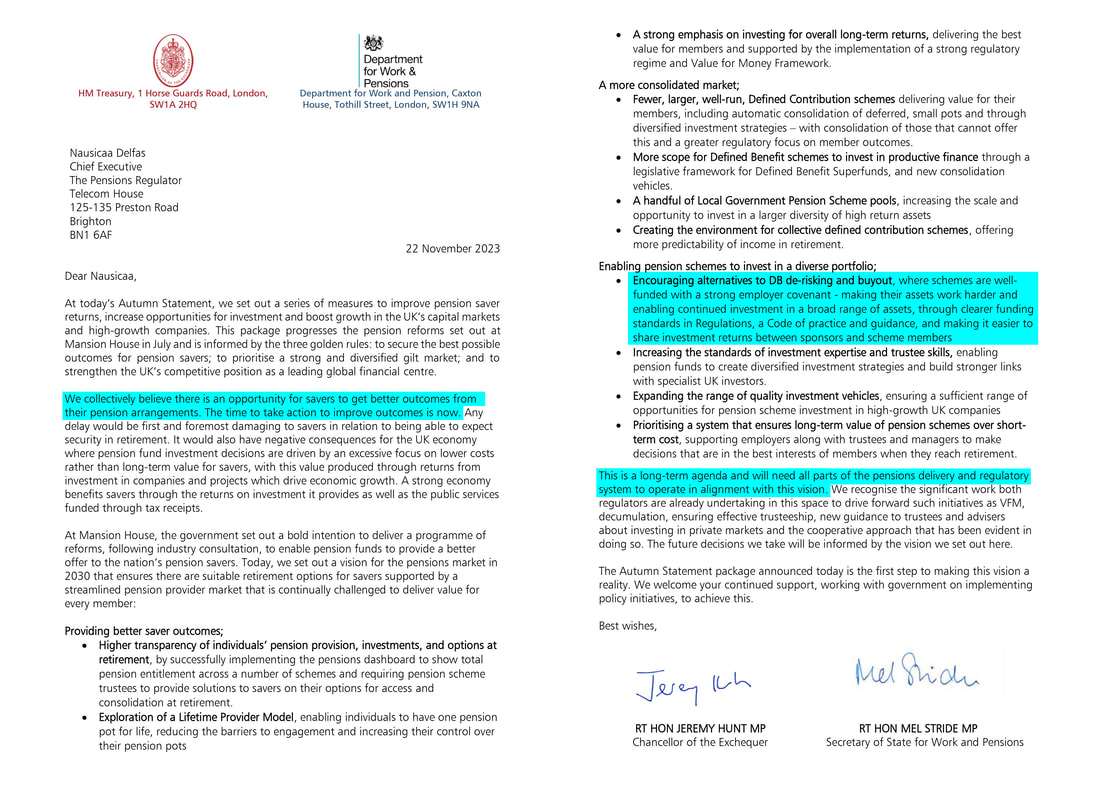

Jeremy Hunt, the Chancellor of the Exchequer and Mel Stride, Secretary of State for Work and Pensions, write in their letters that:

In September C-Suite Pension Strategies wrote to DWP in the Call for Evidence on DB pensions and stated that one sentence from Government would be transformational for the allocation to productive assets and pension provision for past and present employees : “The Government encourage sound sponsors and trustees of well financed DB schemes to run on and modernise them to be ESG Flagships in all stakeholders’ interests.” C-Suite has worked on run on ideas for 5 years and knows how to implement them within existing regulatory and legal frameworks. The action Government wants can start now. Commenting on the Autumn Statement and related letters, C-Suite’s CEO William McGrath said “’Derisk and get rid asap’ now runs against public policy for strong DB scheme sponsors. ‘Run On 4 Good’ replaces the endgame.” Contact us and our leading partners can help you respond positively to the Government’s initiative. The letter to Nausicaa Delfas, Chief Executive of The Pensions Regulator is shown below. The same letter was sent to Nikhil Rathi, Chief Executive of the Financial Conduct Authority. The letters add to paragraph 4.34 in the Autumn Statement on investment in productive assets and the sharing surpluses and tax reductions. 4.34 To increase opportunities for defined benefit schemes to invest in productive finance while fully protecting member benefits, the government will consult this winter on how the Pension Protection Fund can act as a consolidator for schemes unattractive to commercial providers and whether changes to rules around when surpluses can be repaid, including new mechanisms to protect members, could incentivise investment by well-funded schemes in assets with higher returns. The authorised surplus repayment charge will also be reduced from 35% to 25% from 6 April 2024. “Run on pays off” for Defined Benefit schemes with a stable, long term investment strategy: Provide third party, risk diversifying guarantees: All stakeholders can share the benefits and surpluses.

These are the C-Suite themes which go right back to our 2018 webinar setting out a radically different mindset to improve pension provision. Our cutting edge analysis in our paper from 2020, “Running On Pays Off”, showed why an alternative to the rush to “get rid” to a life insurer was needed. The themes are now seen in our “Run On 4 Good” advocacy of aligning corporate and pension scheme ESG thinking. To go mainstream and transform pension provision we urged Government to state that it encourages well funded schemes with strong sponsors to align with its pro-investment thinking. One sentence can be transformational, we noted in responding to the recent DWP Call for Evidence: “The Government encourage sound sponsors and trustees of well funded DB schemes to run on and modernise them to be ESG Flagships in all stakeholders’ interests.” Now Jeremy Hunt has provided an equivalent sentence in his Autumn Statement. Our proposals work within the existing regulatory framework which means you can move forward now rather than wait for legislation. 4.34 To increase opportunities for defined benefit schemes to invest in productive finance while fully protecting member benefits, the government will consult on whether changes to rules around when surpluses can be repaid, including new mechanisms to protect members, could incentivise investment by well-funded schemes in assets with higher returns. The authorised surplus repayment charge will also be reduced from 35% to 25% from 6 April 2024. Should you wish to see how your DB scheme becomes and ESG Flagship we would be pleased to discuss – in particular Discretionary Step Ups and the FM+ approach developed with Van Lanschot Kempen. “Boards and their corporate head office teams should embrace the DB pension scheme opportunities the Chancellor’s initiative provides. All stakeholders benefit.” William McGrath William McGrath Chief Executive, C-Suite Pension Strategies T: 07768 607204 E: w.mcgrath@c-suiteps.com TC Jefferson Chief Executive The Plenum Group & C-Suite Partner T: 07581 466620 E: tc.jefferson@c-suiteps.com |

Archives

April 2024

|

C-Suite Pension Strategies Ltd

80 Coleman Street, London EC2R 5BJ

Registered in England and Wales

Company No. 09974973

80 Coleman Street, London EC2R 5BJ

Registered in England and Wales

Company No. 09974973

RSS Feed

RSS Feed